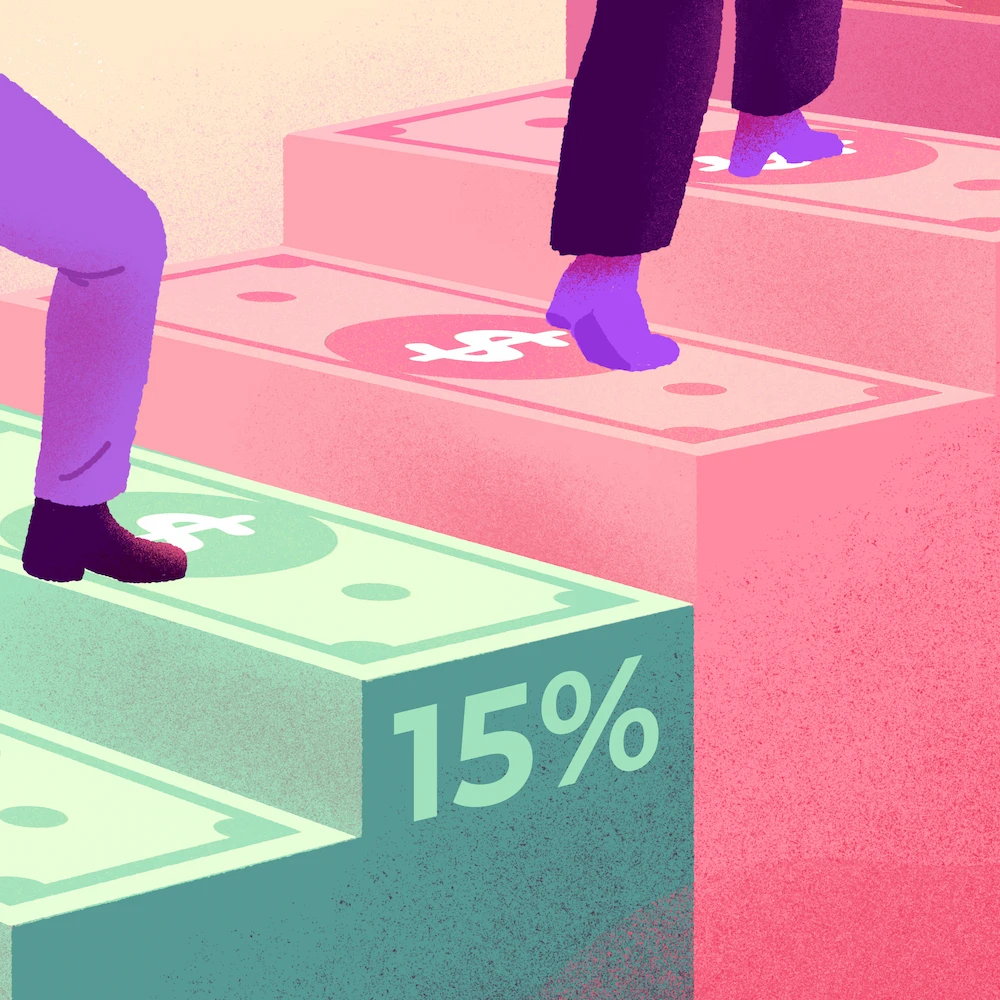

Gross and net pay represent the compensation received by an employee before and after applicable deductions are applied.

What Is the Difference Between Gross and Net Pay?

Gross pay (or gross salary) is the total amount of money given to an employee before deductions and withholdings (taxes, contributions, allowances, fringe benefits, etc.).

Net pay is the net salary received by an employee after deductions and contributions. Net pay is always lower than gross pay.

How to Calculate Gross Compensation and Net Compensation?

Gross compensation is calculated as follows:

Number of hours worked during the applicable period × Hourly rate = Gross pay

For example, an employee works 78 hours for two weeks at an hourly rate of $28. Their gross pay will therefore be $2,184 (78 × 28 = $2,184) for this period.

Net pay is calculated by subtracting deductions and contributions from gross pay. Depending on countries, provinces, or states, retentions can vary. Examples of retentions and contributions to be subtracted include:

- Taxes

- Insurance contributions

- The pension plan contribution

- The employment insurance contribution

- Time off

Why Is Gross Pay Higher than Net Pay?

Gross pay is higher than net pay since it includes deductions and mandatory contributions.

What Is the Difference Between Salary and Remuneration?

Salary is a type of compensation that an employee may receive. It can therefore include the net salary, bonuses, commissions, etc.

Remuneration refers instead to the total benefits or amounts received by an employee. Among other things, it includes salary, bonuses, benefits (company car, welfare allowance, paid childcare expenses, etc.).