Payroll (or pay roll) refers to the processes a company puts into place to compensate their employees in exchange for their work.

How to Calculate Payroll?

To calculate payroll, managers must:

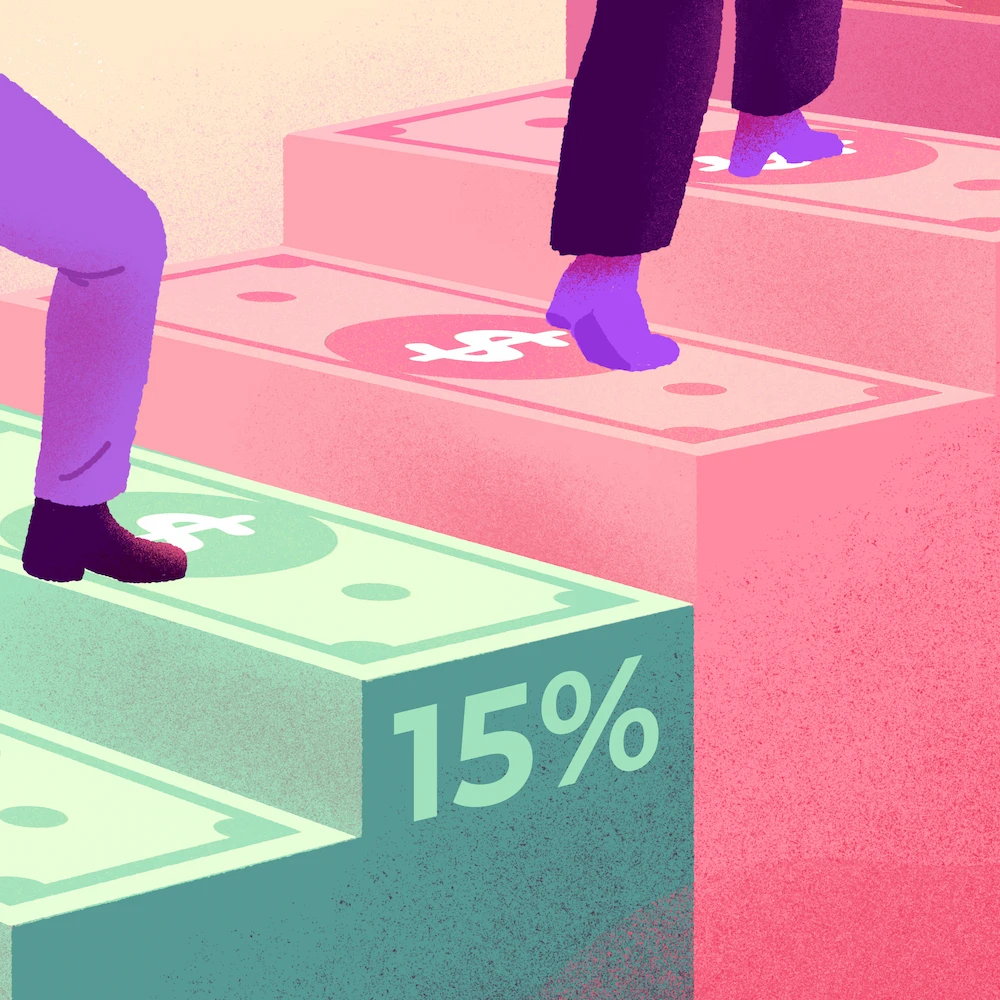

- Calculate the employee’s gross salary for the given period: by multiplying the number of hours worked by the employee’s hourly rate

- Deduct any taxes and fringe benefits offered by the company from the employee’s net salary

- Send payroll information for each employee to the accounting department or a professional payroll service

Why Is Payroll Important?

Payroll is crucial to the smooth running of any business, as it ensures that employees receive fair compensation for the work they do.

Payroll also enables companies to comply with the applicable laws in their country. A company cannot operate without a payroll department.

Is Payroll the Responsibility of HR or Finance?

Managing employee payroll is typically the responsibility of the accounting department (sometimes called finance) or the HR department.

There are no rules to follow, and companies can decide for themselves which department will be responsible for managing employee payroll.

What Should Be In the Payroll?

Payroll content depends on local legislation.

For example, in Quebec, employers must include all information relevant to the employee, such as:

- Employer’s name

- Worker’s name

- Job title

- Work period corresponding to the pay slip

- Date of payment

- Number of hours paid at regular rate

- Number of overtime hours paid and the applicable rate

- Nature and amount of any bonuses, allowances or commissions paid

- Salary rate

- Gross salary amount

- Nature and amount of deductions received

- Net pay

- Tips

How To Automate Payroll?

Companies wishing to automate payroll must first automate the tracking of employee working hours.

Employee timesheets can then be filled in automatically and sent to the payroll department once approved by the manager.

Implementing payroll processing software is necessary to automate payroll, as it will take care of paying each employee’s salary.

What Are Payroll Management Problems?

Payroll management issues include:

- Compliance with current legislation

- Errors or delays in payroll payments

- Time wasted on payroll management

What Are the Challenges of Calculating Payroll?

Payroll challenges include:

- Ensuring that employees’ working hours have been properly recorded using an attendance tracking tool

- Ensuring compliance with current legislation

- Avoiding errors so as not to undermine employees’ trust in their employer

- Ensuring data security and confidentiality

What Is the Difference Between Payroll and Salary?

Payroll refers to the processes involved in the payment of wages, from calculating the pay to depositing the payment into the employee’s account.

An employee’s salary refers to the amount received by an employee as compensation for their work.