Managing work hours and payroll can be challenging for small business owners, especially when it comes to understanding and calculating overtime pay.

With varying overtime rules across Canadian provinces, many businesses struggle to stay compliant and avoid costly errors. This guide includes everything you need to know about overtime pay in Canada, from legal requirements to tax implications, including tools to simplify time tracking and payroll management for your business.

What Does Working Overtime Mean?

Working overtime means working beyond your regular scheduled hours.

According to Canada’s federal labour standards, standard work hours are:

- 8 hours in a day (any period of 24 consecutive hours)

- 40 hours in a week (the period between midnight on Saturday and midnight on the Saturday that immediately follows)

Why Would Employees Work Overtime?

There are several reasons why your business might need its employees to work overtime:

- To meet tight deadlines, especially during busy periods or for time-sensitive projects.

- When there’s an unexpected increase in demand, such as during peak seasons, product launches, or special events.

- To cover for absent staff, ensuring operations continue smoothly without interruptions.

- To maintain productivity until you can hire more employees during a labour shortage or when working with limited staffing.

What Drives Variation in Overtime Pay?

Working overtime can differ by Canadian province as well as by industry and type of work arrangement. As an employer, it’s your responsibility to understand the rules that apply to your specific situation and location.

By Province

Each province and territory has its own labour laws governing overtime, including when it begins, how it’s calculated, and the required compensation.

For instance, in Ontario, overtime pay kicks in after 44 hours in a workweek, whereas in British Columbia, it’s after 8 hours in a day or 40 hours in a week.

By Type of Employment

Full-time permanent employees are often the most likely to be entitled to overtime pay, while part-time and contract workers may have different regulations.

By Industry

Some industries, like agriculture, transportation, or certain management roles, might be exempt from standard overtime rules altogether.

By Agreement

Employees covered by collective bargaining agreements or other specific contracts may have unique overtime conditions.

6 Consequences of Inaccurate Overtime Tracking and Payment

Making errors in tracking work hours and paying overtime correctly can negatively impact your business in several ways.

1. Legal Impacts

- Compliance Issues: Failing to adhere to labour laws regarding overtime can lead to legal challenges, including complaints from employees or audits by labour authorities.

- Fines and Penalties: Businesses may face fines and penalties for violating labour laws, which can be costly and damaging to their reputation

2. Financial Impacts

- Back Pay Obligations: If an employee is found to have been underpaid, the business may be required to pay back wages, including unpaid overtime, which can accumulate to significant amounts.

- Increased Labour Costs: Overpaying employees or correcting errors may require additional resources and time, leading to increased operational costs. This includes potential overtime for HR staff to manage corrections and audits.

3. Human Resources Impacts

- Employee Morale: Mismanagement of pay can lead to decreased employee morale and trust. Employees may feel undervalued or exploited, which can result in disengagement or higher turnover rates.

- Recruitment Challenges: A poor reputation regarding employee treatment can make it difficult to attract top talent. Prospective employees often research companies’ work cultures, and negative reviews can deter applications.

4. Reputational Impacts

- Negative Public Perception: Inaccurate overtime payment can lead to negative reviews and word-of-mouth, harming your business’s reputation in the community and industry.

- Employee Advocacy and Whistleblowing: Disgruntled employees may advocate for better treatment publicly or report violations to labour boards, which can escalate the situation and attract further scrutiny.

5. Operational Impacts

- Increased Turnover Rates: Frequent errors in pay can lead to higher employee turnover, which can lead to additional costs related to recruiting, onboarding, and training new staff.

- Disruption of Workflow: When employees are unhappy about their pay, it can lead to decreased productivity, absenteeism, and a lack of collaboration, disrupting overall business operations.

6. Strategic Impacts

- Loss of Competitive Advantage: A business that struggles with employee satisfaction due to pay issues may find it difficult to compete for talent, ultimately affecting its growth and innovation potential.

- Time and Resource Drain: Correcting pay errors takes time and resources away from strategic business initiatives, impacting overall efficiency and effectiveness.

What’s the Best Way to Track Overtime?

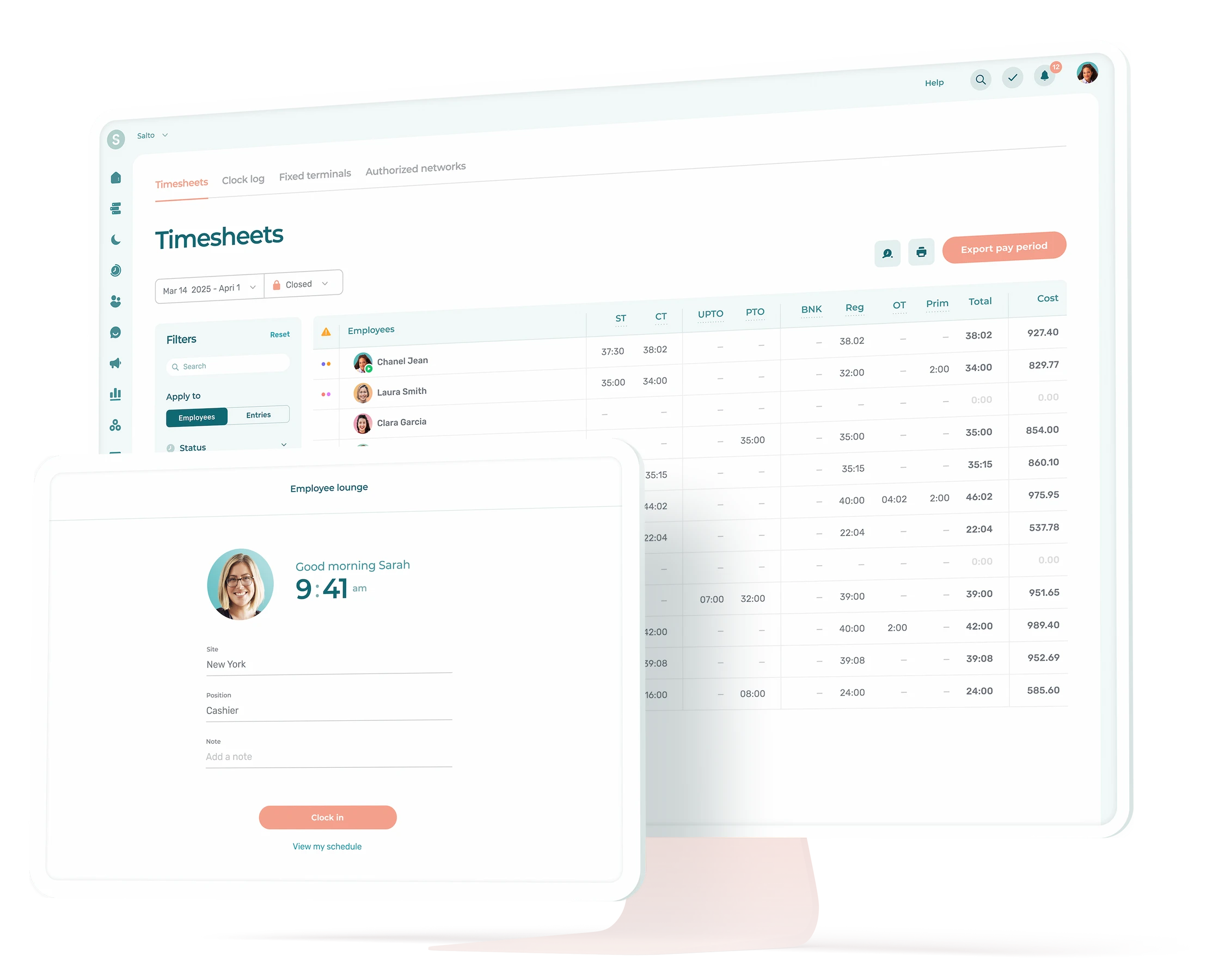

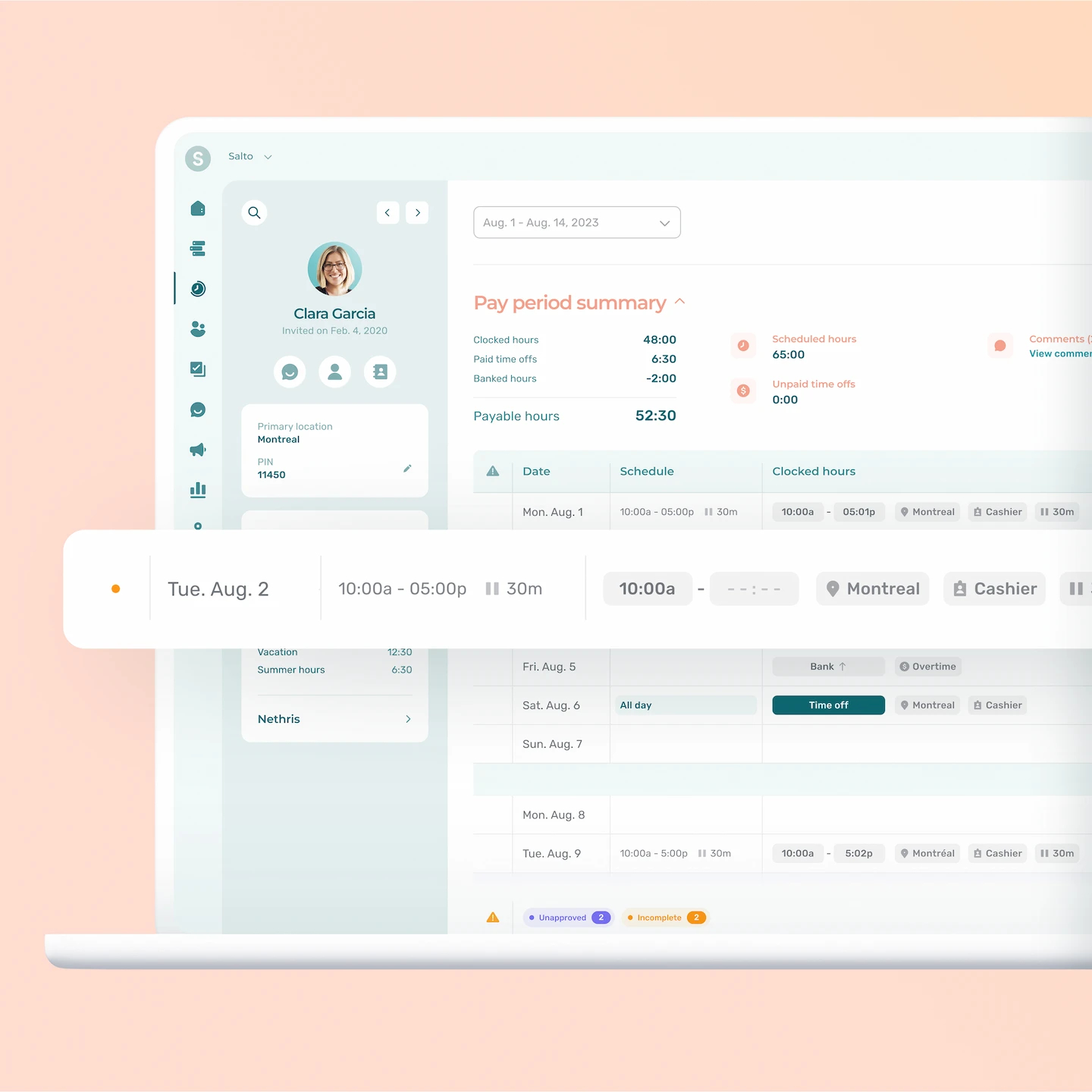

Using employee time tracking software like Agendrix can make tracking overtime simpler and more accurate, reducing administrative hassle and helping ensure compliance with labour laws.

Agendrix allows you to automatically track employee work hours, flagging overtime when thresholds are met. This eliminates manual calculations and minimizes the risk of errors when preparing timesheets for payroll. With Agendrix, you can easily see how many regular and overtime hours each employee works, making payroll preparation more efficient and transparent.

Key features of Agendrix for tracking employee work hours and preparing timesheets

- Automatic Overtime Calculation: Overtime is calculated automatically based on daily or weekly thresholds, so you don’t have to track it manually.

- Mobile Clock-In/Out: Employees can clock in and out from their phones, ensuring accurate time tracking even if they’re working remotely or off-site.

- Timesheet Management: Review and approve employee hours easily, with clear breakdowns of regular and overtime hours for payroll.

- Notifications and Alerts: Receive alerts when employees approach or exceed overtime, allowing you to manage hours more effectively.

- Payroll integration: Export timesheets directly to your payroll system, reducing the time spent on data entry and minimizing errors.

Is Overtime Taxed More?

No, overtime pay is not taxed at a higher rate than regular wages in Canada.

However, when your employees work overtime, it increases their total annual income, which could move them into a higher tax bracket. This means that while their overtime earnings are taxed at the same rate as their regular income, a larger portion of their overall income could be subject to a higher marginal tax rate.

As an employer, you’ll withhold the same types of deductions—such as federal and provincial income taxes, CPP contributions, and EI premiums—from both regular and overtime pay.

How Is Overtime Taxed?

Overtime pay for your employees is taxed in the same way as their regular wages.

When you pay overtime, you’re required to withhold the appropriate amount for income taxes, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums. Since Canada has a progressive tax system, if overtime pushes your employees into a higher income bracket, they may owe more in taxes overall.

At the end of the year, when your employees file their tax returns, any excess withholding might result in a refund, or if too little was withheld, they could owe additional taxes. As an employer, understanding how to calculate and withhold these taxes properly is key to compliance.

How Is Overtime Tax Calculated?

You calculate overtime tax the same way as regular wages for your employees.

Here’s a sample calculation for overtime pay for an employee working at a retirement home, along with an example of how overtime tax may be applied.

Employee Details:

- Hourly Wage: $20.00

- Regular Hours Worked: 40 hours (standard workweek)

- Overtime Hours Worked: 10 hours (in one week)

- Overtime Rate: 1.5 times the regular hourly wage

Calculation Steps:

1. Calculate Regular Pay:

Regular Pay = Hourly Wage × Regular Hours Worked

- Example: Regular Pay = $20.00 × 40 hours = $800.00

2. Calculate Overtime Pay:

Overtime Pay = Hourly Wage × Overtime Rate × Overtime Hours Worked

- Example: Overtime Pay = $20.00 × 1.5 × 10 = $300.00

3. Calculate Total Pay for the Week:

Total Pay = Regular Pay + Overtime Pay

- Example: Total Pay = $800.00 + $300.00 = $1,100.00

Overtime Tax Calculation:

Assuming the employee’s total income places them in a tax bracket where the total tax rate is 25% (this rate can vary based on individual circumstances, including deductions and other income):

4. Calculate Taxes Withheld:

Tax Withheld = Total Pay × Tax Rate

- Example: Tax Withheld= $1,100.00 × 0.25 = $275.00

Summary:

- Regular Pay: $800.00

- Overtime Pay: $300.00

- Total Pay for the Week: $1,100.00

- Estimated Tax Withheld: $275.00

In this example, the employee would take home approximately $825.00 after taxes are withheld, calculated as:

Take Home Pay = Total Pay − Tax Withheld

- Example: Take Home Pay = $1,100.00 − $275.00 = $825.00

Overtime Threshold and Pay Rate by Province

Below are the overtime thresholds and pay rates for each Canadian province and territory. Always refer to your local employment standards for the most accurate and up-to-date information, as labour laws can change.

Overtime in Alberta

- Overtime threshold: More than 8 hours per day or 44 hours per week.

- Overtime pay rate: 1.5 times the employee’s regular rate.

Overtime in British Columbia

- Overtime threshold: More than 8 hours per day or 40 hours per week.

- Overtime pay rate: 1.5 times the regular rate for the first 4 hours over 8 in a day, and 2 times the regular rate for any hours over 12 in a day.

Overtime in Manitoba

- Overtime threshold: More than 8 hours per day or 40 hours per week.

- Overtime pay rate: 1.5 times the regular rate.

Overtime in New Brunswick

- Overtime threshold: More than 44 hours per week.

- Overtime pay rate: 1.5 times the regular rate.

Overtime in Newfoundland and Labrador

- Overtime threshold: More than 40 hours per week.

- Overtime pay rate: 1.5 times the regular rate

Overtime in Northwest Territories

- Overtime threshold: More than 8 hours per day or 40 hours per week.

- Overtime pay rate: 1.5 times the regular rate.

Overtime in Nova Scotia

- Overtime threshold: More than 48 hours per week.

- Overtime pay rate: 1.5 times the regular rate.

Overtime in Nunavut

- Overtime threshold: More than 8 hours per day or 40 hours per week.

- Overtime pay rate: 1.5 times the regular rate.

Overtime in Ontario

- Overtime threshold: More than 44 hours per week.

- Overtime pay rate: 1.5 times the regular rate.

Overtime in Prince Edward Island

- Overtime threshold: More than 48 hours per week.

- Overtime pay rate: 1.5 times the regular rate.

Overtime in Quebec

- Overtime threshold: More than 40 hours per week.

- Overtime pay rate: 1.5 times the regular rate.

Overtime in Saskatchewan

- Overtime threshold: More than 8 hours per day or 40 hours per week.

- Overtime pay rate: 1.5 times the regular rate.

Overtime in Yukon

- Overtime threshold: More than 8 hours per day or 40 hours per week.

- Overtime pay rate: 1.5 times the regular rate.

When Does Overtime Start?

Overtime typically starts after an employee works more than 8 hours a day or 40-44 hours a week, depending on the province or territory. Check local labour laws for specific thresholds.

How Much Do I Have to Pay for Overtime?

Overtime pay in Canada is usually 1.5 times the employee’s regular hourly wage, but this can vary depending on provincial regulations and specific industry exceptions.

Do Part-Time or Contract Workers Get Overtime Pay?

Part-time workers may be eligible for overtime once they exceed the daily or weekly threshold. Contract workers might not qualify for overtime if they’re considered independent contractors, but it depends on the nature of the contract and local laws.

Are There Exceptions to Paying Overtime?

Yes, some industries, job roles (like managers), or specific agreements may be exempt from standard overtime rules. Check your province’s labour standards for industry-specific exemptions.

How Do I Calculate Overtime Pay?

Add the employee’s regular hourly wage to their overtime hours worked, then multiply by 1.5 (or the applicable overtime rate). Ensure taxes and deductions are applied correctly, as with regular wages.