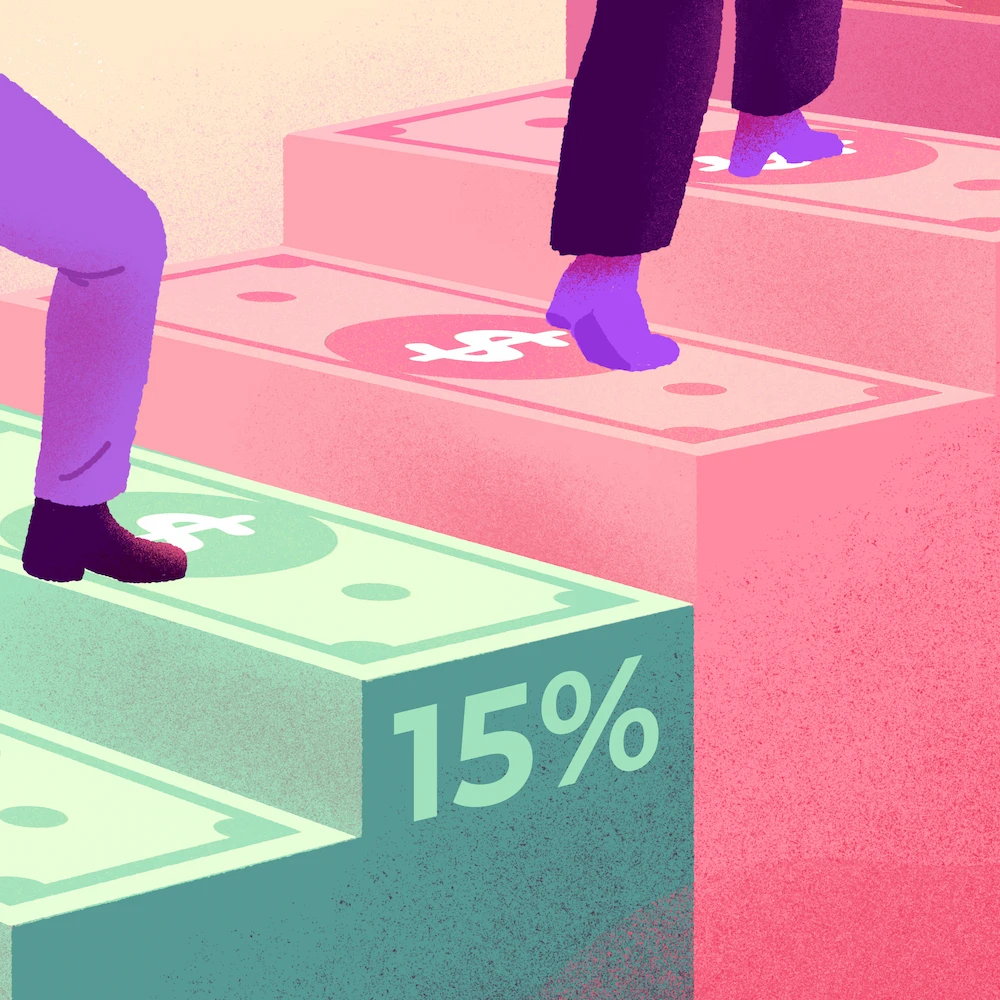

Payroll deduction, also called deduction at source or payroll withholding, refers to the part of an employee’s salary that is directly deducted from their pay by their employer.

What Are the Different Forms of Payroll Deduction?

An employer can withhold part of a salary for various reasons, such as:

- Deduction for damage to equipment in the event of gross, intentional misconduct

- Payroll deduction due to lateness or absence

- Payroll deduction as a result of overpayment

- Deduction at source provided for by the law

- Deduction at source authorized by a legal ruling

How to Calculate Payroll Deduction?

Payroll deduction is calculated pro rata to the employee’s salary.

In Canada, the amount depends on the reason for the deduction. If it is due to deliberate damage to equipment, the employee may be made to refund the whole of the amount lost due to their behavior. However, the employer must obtain written authorization before deducting sums.

When Can an Employer Deduct Part of a Salary?

An employer can deduct part of a salary with the aim of resolving a situation. They cannot deduct part of a salary with the aim of sanctioning an employee.

For example, if an employee breaks a machine by mistake, the employer cannot deduct part of their salary. However, if the latter can prove that the employee deliberately broke the equipment to intentionally harm the company, they can do so.

In Canada, the employer must obtain written authorization from the employee before making a salary deduction.

What Are the Salary Deductions That Apply in Canada?

Authorized salary deductions that apply in Canada include:

- Deductions for training

- Deductions for unreturned goods

- Salary deductions usually form part of the remuneration policy and are included in the employee’s employment contract.