- FeaturesFeatures

Save up to 50% in

your scheduling time.See how Agendrix will

help you save time and energyDiscover Agendrix

in a glimpse.2 min. to get

you convinced - IndustriesIndustries

More than 40 000

5-star reviews. - Resources

- Pricing

- Book a demo

- FeaturesFeatures

Save up to 50% in

your scheduling time.See how Agendrix will

help you save time and energyDiscover Agendrix

in a glimpse.2 min. to get

you convinced - IndustriesIndustries

More than 40 000

5-star reviews. - Resources

- Pricing

- Book a demo

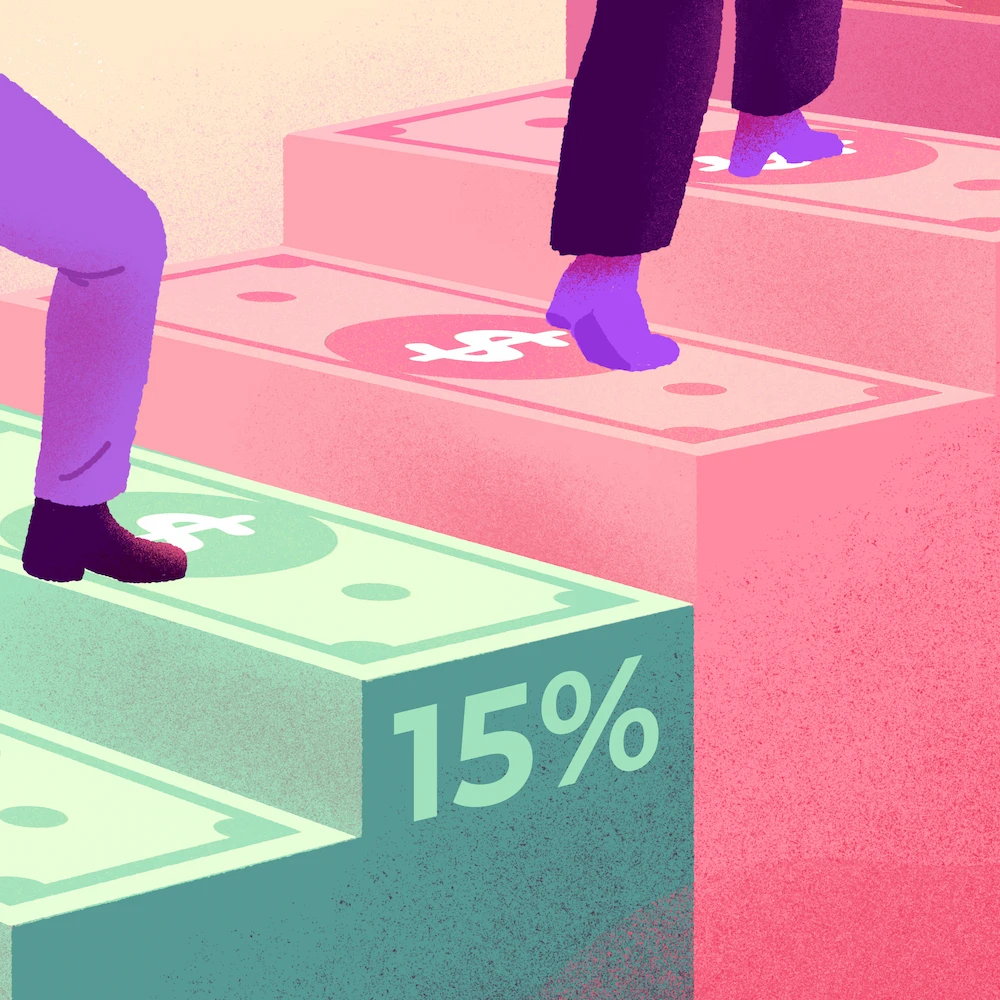

Annual income is the total amount of money earned by a person over a one-year period before deductions.

How to Calculate Annual Income?

Annual income is the sum of all forms of compensation, or sources of income, received by a person over a one-year period. To accurately calculate annual income, all sources of income should be taken into consideration.

Common sources of income include:

- Employment wages and salary;

- Commissions, overtime pay, bonuses;

- Self-employment income;

- Capital gains;

- Pension and social security;

- Child support and alimony;

- Disability and welfare;

- Income and interest from investments;

- Income from rental of properties.

What Is the Difference Between Annual Income and Gross Income?

Annual income represents the total amount of money earned by a person over a one-year period, after deductions, whereas gross income represents this amount before deductions.

Some terms that might you might like.

People Management

5 min.

11 Tips and Best Practices for Minimizing Employee Overtime

Andrée-Anne Blais-Auclair

Marketing Content Manager

Business Operations

9 min.

Is Overtime Taxed More – Guide for Canadian Business Owners

Andrée-Anne Blais-Auclair

Marketing Content Manager

Business Operations

7 min.

PTO Tracking Software: Your Best Ally to Plan Summer Vacation

Sarah Busque

Marketing Content Manager

Discover Agendrix. Manage better.

Up to 21 days of free trial. Easy setup. Cancel anytime.