A per diem rate refers to the amount charged to a client for the work of a self-employed person for one full day of work.

What Is the Average Per Diem Rate?

The average per diem rate corresponds to the average remuneration of self-employed workers in a given industry for the equivalent of one full day of work.

The average per diem rate serves as a guideline. It makes it possible to compare the tariffs of different self-employed workers.

How to Calculate the Average Per Diem Rate?

In order to calculate an average per diem rate, the following information must be considered:

- Charges (taxes)

- Operational costs (material, training, administrative time)

- Time off (to ensure income during periods of inactivity)

- Market rates

- The added value of the service performed

- Business objectives

- Skills and experience

- Project deadlines

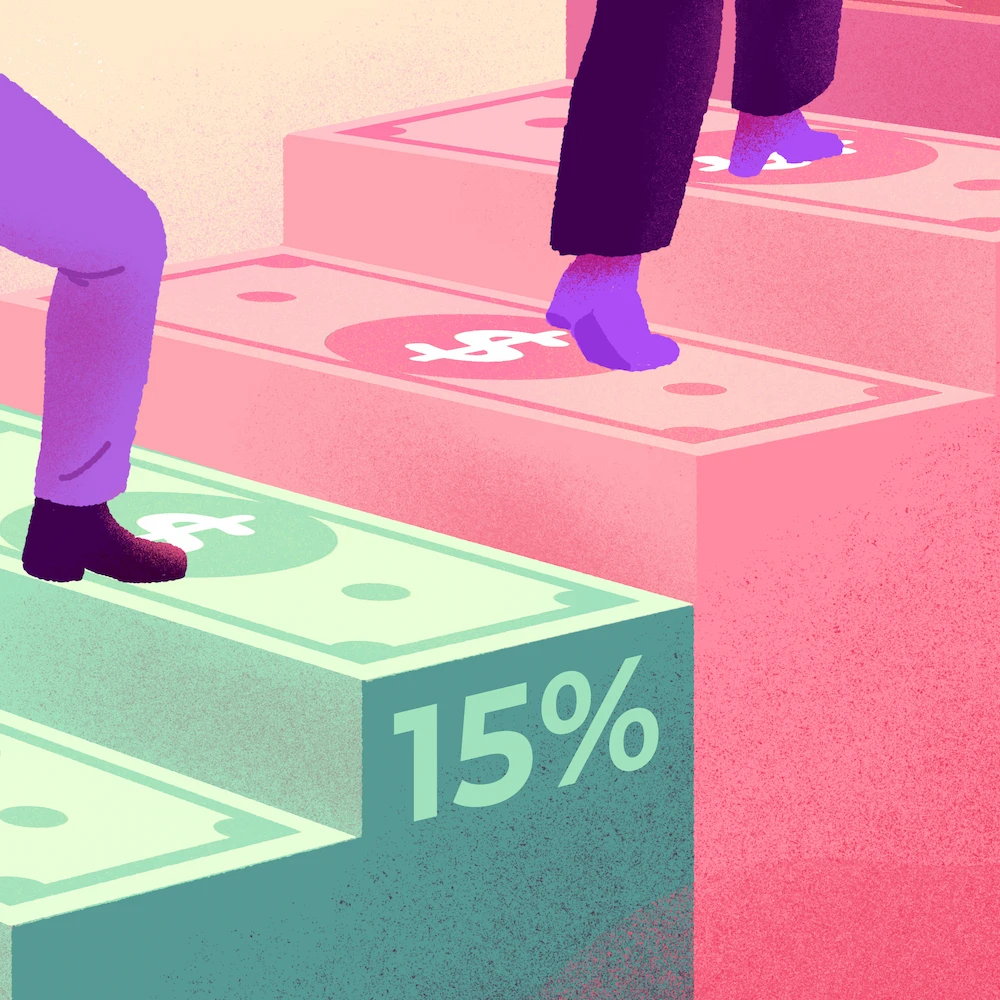

The following formula can be used to calculate the average per diem rate:

(Annual Personal Expenses + Annual Business Expenses) ÷ Annual Billable Days Worked = Average Per Diem Rate

For example, a self-employed individual who spends $50,000 per year on personal needs and $20,000 on business operations and has 168 billable days of work per year would have an average day rate of $416.67 ($50,000 + $20,000) ÷ 168 = $416.67.

What Are the Advantages of a Per Diem Rate?

The advantages of the per diem rate include:

- Ensuring a more stable revenue

- Standardizing service provision

- Allowing better planning of work

What Are the Risks Linked to a Per Diem Rate?

The risks of the per diem rate include:

- Not considering the added value of the project

- Not considering delivery times

- Lack of flexibility