Deferred compensation refers to a portion of an employee’s salary that is retained and paid out later.

How Does Deferred Compensation Work?

Deferred compensation is used to retain a portion of the salary that will be used in retirement, pension or stock option plans, for example.

Deferred compensation plans are typically offered by companies as part of their fringe benefits package. An employee can use them to take deferred leave and continue to receive a portion of their salary during an extended absence.

An employer may also contribute to an employee’s RRSP, or place money in a pension plan to which the employee will have access once they retire.

Deferred compensation is generally included in an employee’s employment contract.

What Are the Different Types of Deferred Compensation?

The different types of deferred compensation are:

- Pension plans

- RRSP contributions

- Retirement pensions

- Salary reduction arrangements for deferred leave

- Deferred bonus payments

What Is an Example of Deferred Compensation?

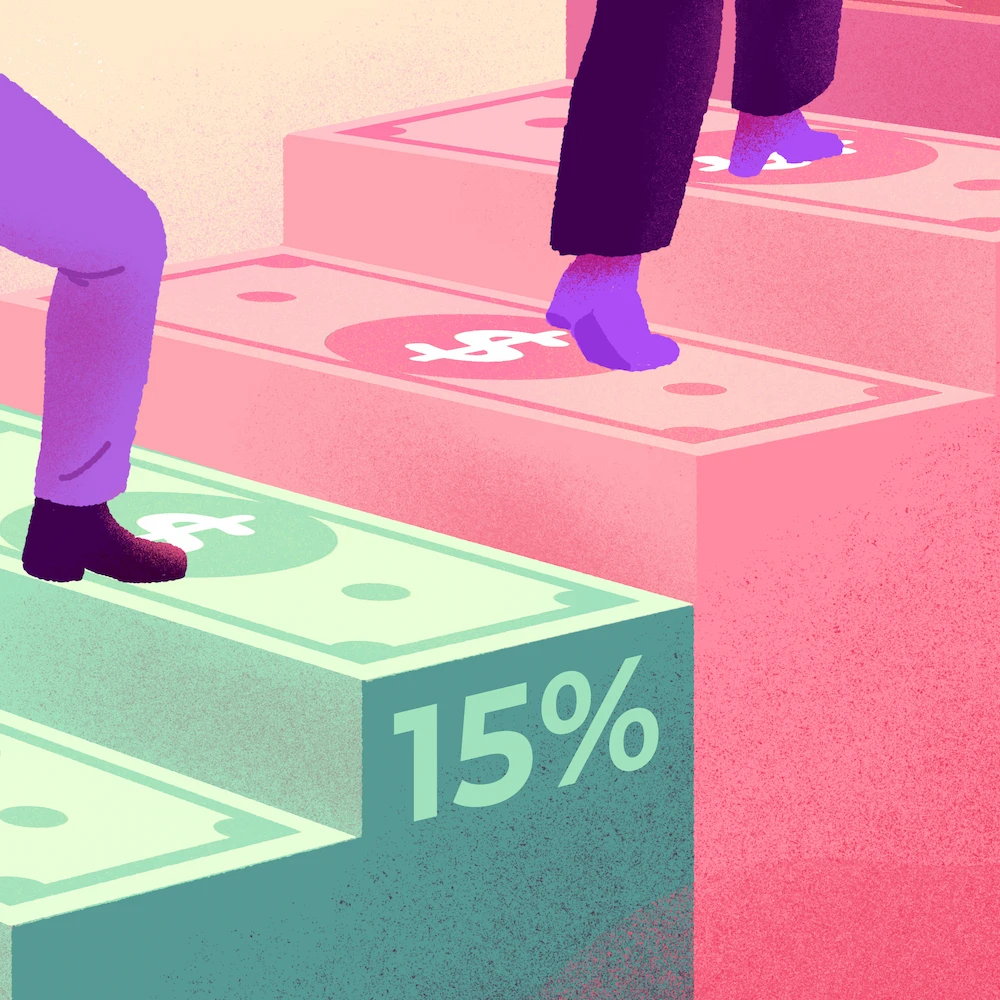

Some employees are able to take a one-year leave every 4 years through deferred compensation. These employees receive 75% of their annual salary for 3 years, and receive the amount set aside during their leave. This enables them to earn a lower, but fixed, salary for 4 years.

What Are the Benefits of Deferred Compensation?

The benefits of deferred compensation include:

- Allowing employees to take deferred leave

- Avoiding employees having to pay taxes on a portion of compensation until it is paid out

- Growing a portion of compensation before it is paid out

- Offering more flexibility to employees

What Are the Disadvantages of Deferred Compensation?

The disadvantages of deferred compensation include:

- Limits on contributions

- Loss of a portion of investments

- Lack of flexibility in accessing amounts set aside