- FeaturesFeatures

Save up to 50% in

your scheduling time.See how Agendrix will

help you save time and energyDiscover Agendrix

in a glimpse.2 min. to get

you convinced - IndustriesIndustries

More than 40 000

5-star reviews. - Resources

- Pricing

- Book a demo

- FeaturesFeatures

Save up to 50% in

your scheduling time.See how Agendrix will

help you save time and energyDiscover Agendrix

in a glimpse.2 min. to get

you convinced - IndustriesIndustries

More than 40 000

5-star reviews. - Resources

- Pricing

- Book a demo

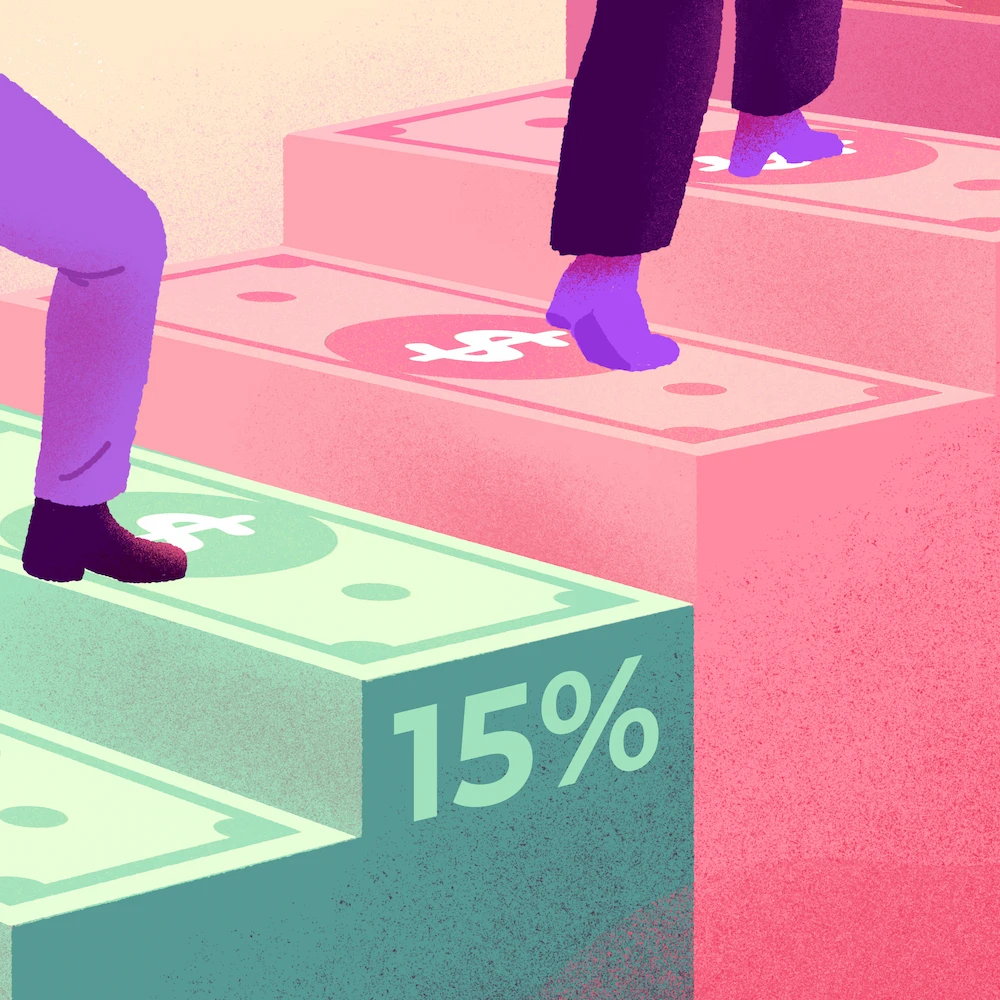

Imputed income refers to a portion of an employee’s income, such as certain social benefits, that can be subtracted from total income for tax purposes.

What Are Some Examples of Fringe Benefits Subject to Income Imputation?

Examples of fringe benefits subject to income imputation generally include:

- A company car

- An employee discount

- Reimbursement of expenses (training costs, childcare costs, public transport, etc.)

- Insurance

For What Purposes Can an Employee’s Income Be Imputed?

Imputation of an employee’s income is used to collect income tax for the government. Income can also be imputed to provide tax relief for employees.

Some terms that might you might like.

People Management

5 min.

11 Tips and Best Practices for Minimizing Employee Overtime

Andrée-Anne Blais-Auclair

Marketing Content Manager

Business Operations

9 min.

Is Overtime Taxed More – Guide for Canadian Business Owners

Andrée-Anne Blais-Auclair

Marketing Content Manager

Business Operations

7 min.

PTO Tracking Software: Your Best Ally to Plan Summer Vacation

Sarah Busque

Marketing Content Manager

Discover Agendrix. Manage better.

Up to 21 days of free trial. Easy setup. Cancel anytime.