Payroll can quickly become a mess with all the possible calculation mistakes and missed deductions. Looking to streamline this process? Payroll automation is the solution you’ve been hoping for.

Managing employee payroll is about more than just simple calculations—it’s a responsibility that requires legal compliance. It also impacts team motivation and the financial health of a company.

Yet, for many SMBs and even large organizations, this process is still often handled manually. This makes it tedious and a potential source of costly errors.

Payroll automation changes the game. It frees HR managers from repetitive tasks and centralizes payroll and HR processes in a fast, secure, and efficient management system.

By choosing automated payroll software, you can transform the way you handle pay and offer your employees a better overall experience.

What Is Payroll Automation and How Does It Work?

Payroll automation involves using a payroll management software to reduce manual calculations and cut down accounting errors in the payroll process. Some payroll management tools can even be integrated with other HR software to centralize all employee management tasks.

A payroll automation system is based on algorithms and databases that process employee information according to current regulations and the company’s internal policies.

Payroll software handles everything from collecting employee data—like work hours, overtime, leave, and absences—to performing complex calculations such as gross and net pay, deductions, and contributions. It also generates payroll reports and tax documents, all while ensuring compliance with current labor laws.

Which Payroll Management Tasks Can Be Automated?

Payroll management tasks include:

- Calculating gross and net pay

- Managing tax and social contribution withholdings

- Creating and sending digital pay slips

- Tracking paid leave, absences, and overtime

- Processing and distributing employee pay

- Verifying payroll accuracy before processing

- Generating required tax reports and filings

- Producing employee tax forms (e.g., year-end slips)

- Distributing payroll documents to employees

- Updating employee data as needed

- Generating payroll reports and audit trails

- Archiving payroll records securely

- Ensuring employee data protection and compliance

With the right software for your business, all of these tasks can be handled automatically—saving time, reducing errors, and ensuring compliance.

What Are the Types of Payroll Automation Systems?

There are three types of payroll automation systems:

1. Cloud-Based Software (SaaS): Also known as online payroll systems, these are accessible via the web and regularly updated by the provider. They offer flexibility, scalability, and ease of use for businesses of all sizes—from startups to large organizations.

2. On-Premise Software: Installed directly on your company’s local servers, these systems are managed in-house and require manual maintenance and updates.

3. ERP software (Enterprise Resource Planning): These systems are integrated into the company’s broader management infrastructure, such as employee management systems.

What Are the Steps to Automate Payroll?

Payroll automation helps optimize salary management and reduce errors. Here are the essential steps to successfully make the transition:

1. Choose the Right Payroll Software

To choose the right payroll software, it’s essential to take the time to understand your needs and do some research to find the solution that suits you best.

Here are some questions to guide your reflection and research:

- What is my budget?

- How many employees does my company have?

- Does the software need to integrate with other HR or accounting tools?

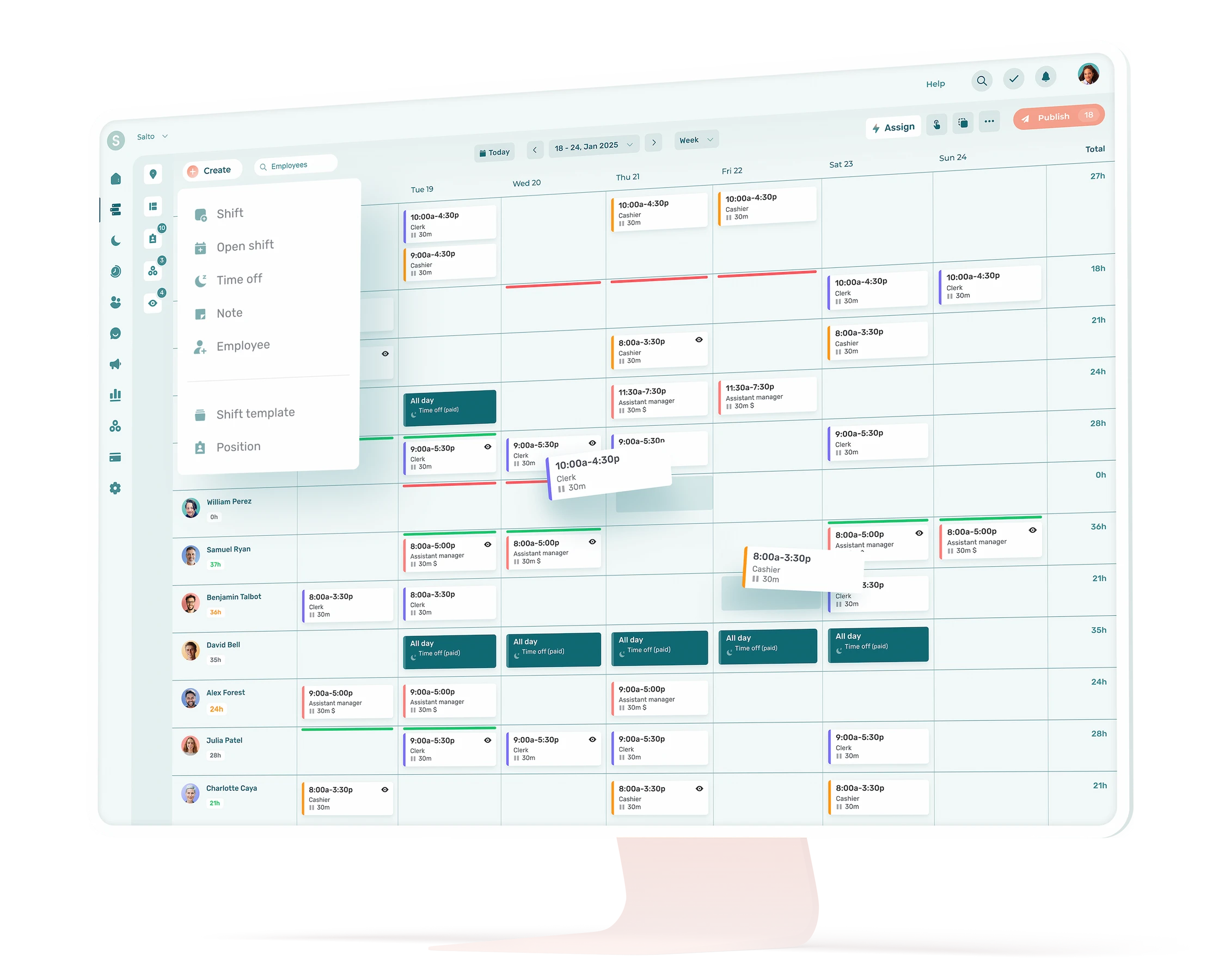

For instance, platforms like Agendrix integrate seamlessly with several payroll management systems—making it easier to centralize your HR and payroll processes.

- What type of solution is best suited for my needs?

- Does the software offer automatic updates?

- Will I need to provide additional training so my team can use the software?

- Does the software include built-in training or onboarding support?

- What is the length of the contract?

- What are users saying online?

- Can I try the software for free?

2. Train Payroll Managers

Once you’ve selected your payroll software, make sure your team is properly trained to use it effectively from day one.

Most providers offer training sessions, either live or self-guided, that your employees can attend. You may also choose to send one employee for in-depth training. That person can then act as the go-to resource and train other key users among your staff.

It’s also important to set up an internal guide to help resolve common issues and manage exceptions (holidays, bonuses, absences, etc.).

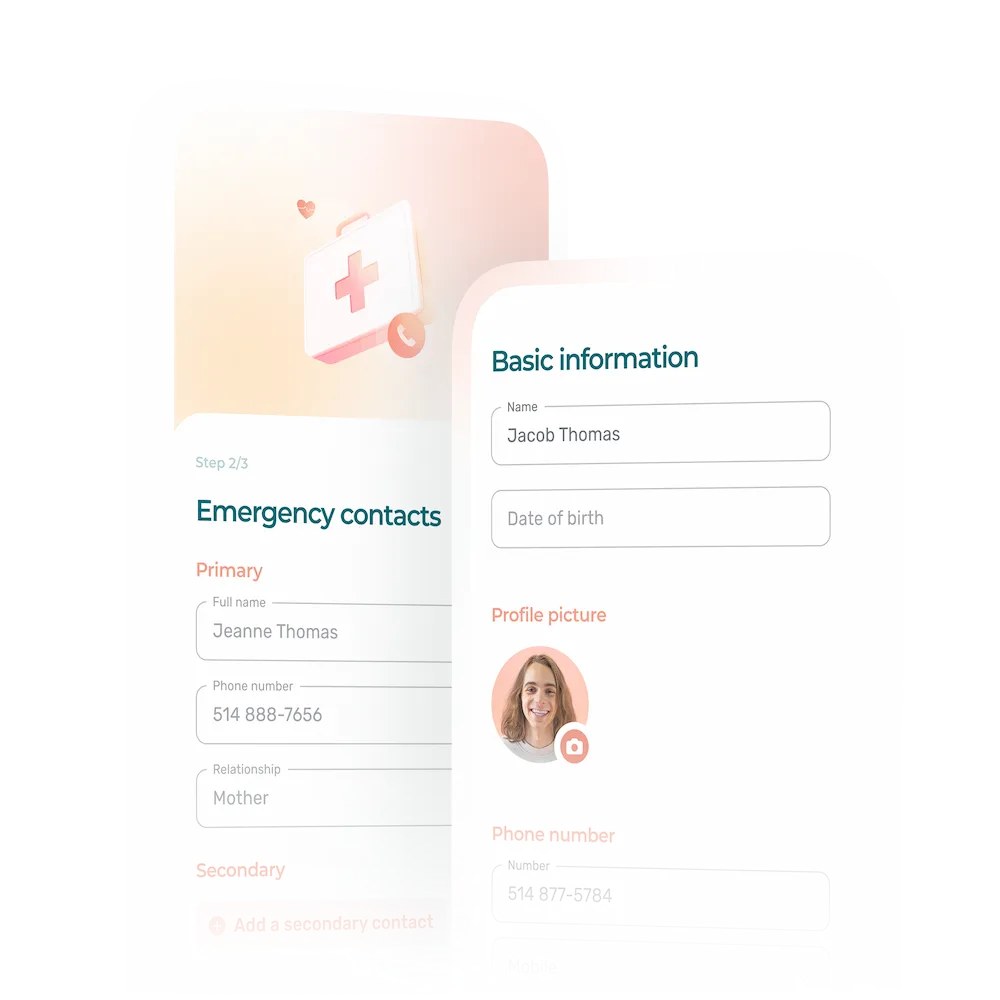

3. Input Employee Data Into the Software

One of the first steps in setting up payroll automation is creating employee profiles within the system. Take the time to review each employee’s file and enter all relevant details into your payroll management system. This ensures accurate and compliant payroll processing from day one.

Key information to include:

- Full name

- Contact details (email, phone, address)

- Contract type (e.g., full-time, part-time, fixed-term)

- Salary details

- Bonuses, premiums, and benefits

- Tax and bank information (for deductions and direct deposits)

4. Automate Time and Attendance Tracking

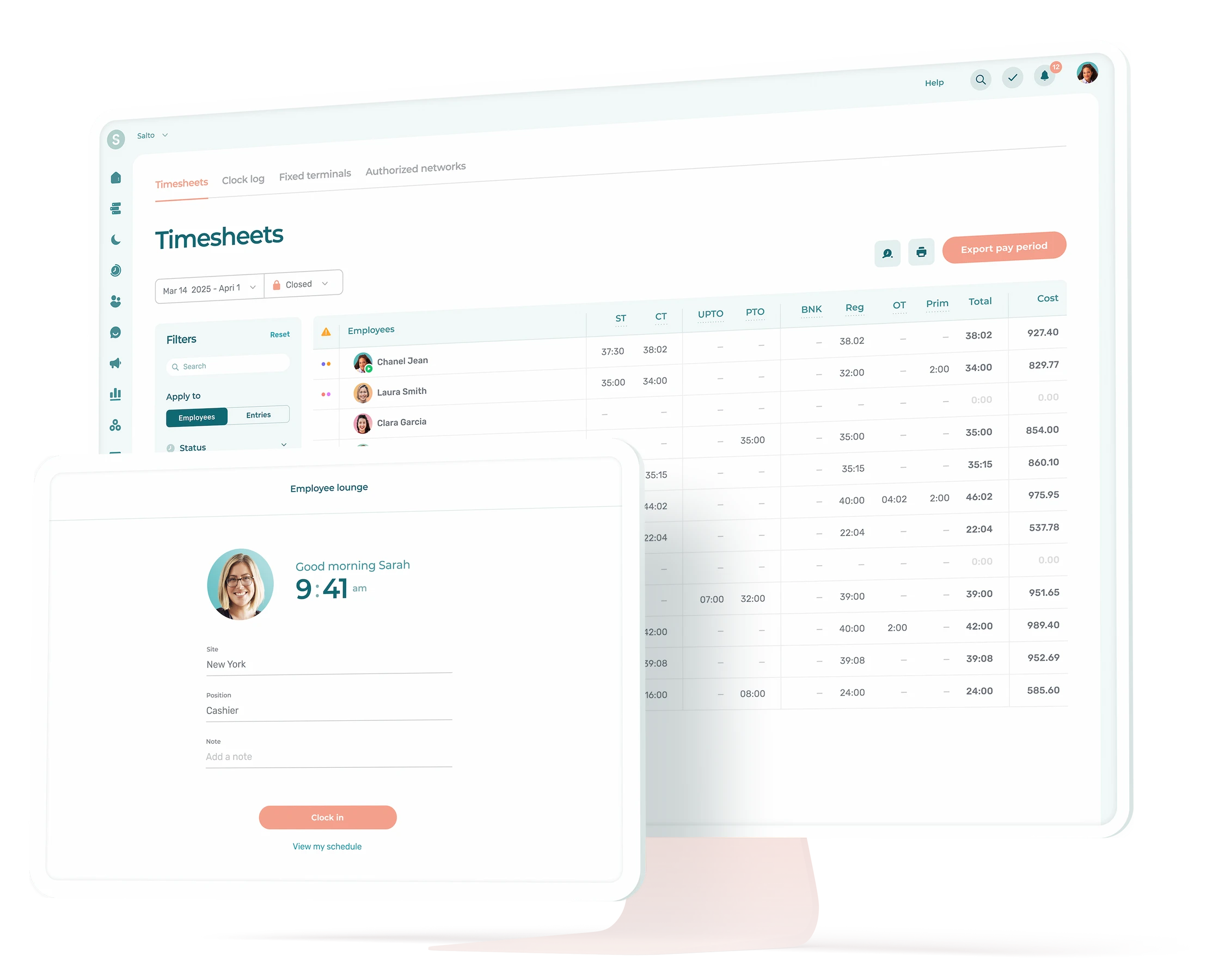

Payroll software alone is often incomplete when it comes to tracking employee time and attendance. Therefore, most payroll systems benefit from being integrated with your scheduling management software.

Sync your payroll software with your time tracking software so that timesheets can be transferred as soon as they are approved. Make sure to set the correct settings for calculating overtime and leave in order to avoid errors.

5. Define Pay Cycles and Payments

Choose the right pay cycle (weekly, bi-weekly, monthly) to ensure your employees are paid on time. Don’t forget to clearly define the different pay periods.

6. Automate Tax Deductions and Declarations

It’s important to clearly define all the criteria the software must meet to correctly calculate a company’s tax obligations. This ensures accurate filings and helps avoid problems.

Make sure to properly configure tax calculations, various contributions, and specific deductions. This will allow the software to generate the necessary reports and filings.

7. Perform Regular Follow-Ups and Adjustments

Payroll automation still requires regular follow-ups and adjustments.

Make sure that you remain compliant with legal changes and perform audits to detect errors more quickly. You can also gather feedback from your employees and adjust your processes accordingly.

8 Benefits of Payroll Automation for Your Business

1. Save Time and Cut Costs

Payroll automation drastically reduces the time spent on manual tasks (data entry, calculations, filings). As a result, administrative costs go down, and managers can focus on higher-value tasks.

The efficiency gained helps justify the return on investment associated with the cost of implementing payroll software.

Example

A restaurant’s manager no longer needs to spend hours preparing pay slips each week. Thanks to software like Agendrix that is linked to the payroll system, pay is automatically calculated from approved work schedules, freeing up time to focus on improving the customer experience.

2. Reduce the Risk of Errors

Payroll errors can be costly and lead to fines, internal conflicts, time-consuming corrections, and even high employee turnover.

Automation reduces these risks by standardizing calculations and processes. Results translate into accurate payroll, on-time payments, and fewer mistakes across the board.

Example

In a construction company, employees often work irregular hours, receive bonuses, or log significant overtime. Payroll software helps eliminate calculation errors and ensures that every employee is paid fairly and accurately—no matter how complex their schedule.

3. Ensure Compliance with Current Laws

Most payroll software is regularly updated to reflect changes in tax laws and labor regulations. This ensures your business remains compliant with current tax and workplace laws.

Example

In a pharmacy, managing part-time contracts, night shifts, and statutory holidays involves strict compliance with labor laws and collective agreements. Payroll software automates these processes, ensuring correct reporting and legal compliance—offering peace of mind, especially during audits.

4. Improve Employee Satisfaction

Frustrations related to payroll errors can greatly affect employee motivation and satisfaction. That’s why a tool like payroll software that automates processes can help contribute to employee satisfaction.

Payroll software also allows employees to easily access their tax documents when needed.

Example

In a grocery store, employees can access their pay stubs and tax slips directly through the payroll software’s mobile app. This reduces the number of requests managers or HR receive, all while promoting greater transparency and autonomy in the workplace.

5. Offer More Flexibility

Cloud-based payroll software (SaaS) gives both managers and employees the flexibility to access payroll data anytime, from any device. These solutions are also easily scalable and adaptable, making them ideal for growing businesses or seasonal operations that require quick adjustments.

Example

An event planning company can increase its subscription plan during peak season to accommodate more staff and scale it down during slower months. This helps reduce operational costs while supporting long-term sustainability. Plus, managers can access payroll tools on the go—no matter where their work takes them.

6. Accelerate Business Growth

Automating payroll processes allows your company to scale more efficiently as operations expand. Adding new employees to pay cycles or generating more tax filings becomes much easier, without adding extra administrative burden.

This level of flexibility supports healthy, sustainable growth while keeping processes efficient and compliant.

Example

A retail chain opening new store locations can easily onboard new employees into the existing payroll system—without needing to hire a dedicated HR manager for each store. This centralizes operations and keeps costs under control as the business grows.

7. Simplify Employee File Management

When all employee data is centralized in one place, HR tracking becomes significantly easier. Everything managers need is available in just a few clicks. This frees up time to focus on high-value tasks like training, onboarding, and recruitment.

Example

In a restaurant with high employee turnover, managers can quickly access former employees’ records when time comes to send out tax slips. This prevents delays and mistakes often caused by disorganized or scattered HR documentation.

8. Improve Data Security

Payroll management software secures confidential information and protects the company against data theft or accidental data leaks.

Example

In a retirement home, employees’ salary and personal information are protected and only accessible to authorized personnel.

Common Challenges of Payroll Automation and How to Overcome Them

1. Initial Setup and Learning Curve

Implementing payroll software can be a complex process, especially at the beginning. It often requires time for teams to adjust and learn how to use the new system effectively. To ensure a smooth transition, employees may need extra training to build confidence and stay up to date with new workflows.

Solution: Support rollout of the new software by offering internal training and ensuring that the chosen solution does provide technical support when needed.

2. Managing Configuration Errors

A poor initial setup or incorrect changes can lead to payroll or compliance errors. These issues can be complex to resolve and may cause frustration or delays in salary payments.

Solution: Have an internal payroll expert or a consultant from the software provider validate your settings before launching the system.

3. Integration with Existing Systems

The chosen payroll software may not be compatible with the HR tools or time-tracking systems already in use within your company.

Solution: Choose a software solution that offers APIs or that is compatible with your existing systems.

4. Team Resistance to Change

Change can be uncomfortable—especially when it affects daily routines. Some employees may be hesitant to adopt a new payroll system, fearing complexity or losing their familiar ways of working. This resistance can lead to decreased motivation or even frustration within the team.

Solution: Involve employees from the beginning, explain the concrete benefits, and offer human support throughout the transition.

5. Keeping Tax and Legal Data Up to Date

Payroll laws and tax regulations are constantly evolving. Failing to stay compliant can lead to penalties, audits, or legal issues for your business.

Solution: Choose a payroll software that offers automatic updates in line with the latest legal and tax requirements. This ensures ongoing compliance without putting extra pressure on your internal teams.

6. Tracking Absences and Leave

Poor tracking of employee absences and leave can lead to payroll errors.

Solution: Integrate employee time and attendance tracking software like Agendrix with your payroll system.

7. Data Security

Confidential information can be at risk in the event of a data breach or hacking.

Solution: Choose software that complies with strict security standards.

Integrating Time Management and Payroll Systems: The Way to Go

It is essential that your payroll automation system can integrate with your time management software in order to simplify your personnel management tasks.

So take the time to thoroughly research the different software options available to choose one that best fits your needs.

If you are using the Agendrix scheduling software, the following payroll systems can be integrated:

- EmployeurD

- Nethris

- Sage 50

- Acomba

- QuickBooks

- Ceridian Powerpay

- BeLocum

- Hopem

- Lightspeed

- ADP Workforce Now

- Azur

- Payworks

Adopting Payroll Automation

Payroll automation is a key performance lever for any business looking to simplify human resources management while ensuring legal compliance.

It’s much more than just a productivity booster—it’s a strategic tool that supports growth, compliance, employee satisfaction, and security. In all industries, from small to large businesses, it allows for the efficient management of human capital—one of the most important pillars for an organization’s success.

What Is Payroll Automation?

Payroll automation involves using software to automatically manage all stages of salary processing within a company.

This includes wage calculations, tax and social contribution withholdings, sending payslips, bank transfers, and filing reports with government agencies.

Which Payroll Management Tasks Can Be Automated?

The payroll management tasks that can be automated include:

- Calculating wages

- Calculating deductions and contributions

- Time and attendance tracking

- Payslip generation

- Social and tax filings

- Salary payments

- Reporting and auditing

- Data archiving

- Data security

What Are the Main Advantages of Payroll Automation?

The main advantages of payroll automation include:

- Time savings

- Lower operational costs

- Fewer errors

- Legal and tax compliance

- Improved employee satisfaction

- Greater flexibility and accessibility

- Improved business performance

- Centralized data and tracking

- Enhanced data security