Key takeaways

- The best payroll software for small businesses in Canada (2026): Wagepoint (overall), QuickBooks Payroll (with QuickBooks), Payworks (service-led), Nethris (Quebec compliance), ADP Workforce Now (complex/multi-province), Ceridian Dayforce Powerpay (compliance-first), Employer D (Quebec-first), Knit People (modern UI), PaymentEvolution (per-run pricing).

- Payroll software automates tax calculations, ROEs, T4s, and direct deposits so small business owners can stop spending hours on spreadsheets.

- Hourly teams need accurate time and attendance data before payroll runs begin. That is where payroll preparation platforms like Agendrix shine.

- Pricing models vary: from per-run to monthly base + per-employee. Always verify current CAD pricing.

- If you run hourly teams: Use a payroll-prep layer (like Agendrix) to feed clean, approved hours into payroll.

Looking for the best payroll software for small businesses in Canada in 2026? Here are the options Canadian SMBs actually use, with prices, bilingual support, and CRA-compliant features compared side-by-side.

For Canadian SMBs juggling hourly staff, tight margins, and ever changing labor rules, the right payroll tool can be the difference between smooth sailing and a monthly administrative meltdown.

Running payroll manually is a special kind of chaos. Canadian payroll has only grown more complex. Small businesses now manage a mix of hourly and salaried staff, multiple pay rates, varying overtime rules, statutory holidays, sick leave, and province specific regulations. Pair all that with Canada Revenue Agency (CRA) remittances and year end forms like T4s and ROEs, and the margin for error gets tight. Very tight.

61.2% of Canadian businesses expect cost-related obstacles in the next months (inflation, input costs, interest/debt), a strong case for automating time-to-payroll workflows to control admin spend. (Statistics Canada, CSBC Q4 2025.

This guide breaks down the best payroll software for small businesses in Canada in 2026, focusing on platforms that are accurate, affordable, and designed for teams under one hundred employees. Whether you run a café, a retail shop, a senior’s residence, or a seasonal business with lots of hourly staff, you will find tools here that simplify your payroll life.

Methodology: How We Evaluated Payroll Software

Choosing payroll software is not just about finding something that can run paycheques. It is about accuracy, compliance, ease of use, and how well the system fits the reality of your small business. Since teams under one hundred employees make up the backbone of our economy, we focused on tools built for that scale.

To keep this guide practical and unbiased, we evaluated each payroll platform using a clear scoring system based on the needs of Canadian SMBs. We dug into technical documentation, customer feedback, public reviews, and our own experience supporting thousands of small businesses every year.

Below is the exact scoring rubric used for every tool in this list.

Scoring Rubric (100 🍁)

Payroll Accuracy & CRA Compliance (35 🍁)

Payroll accuracy is the foundation of everything. We scored tools based on:

- The precision of payroll calculations

- Automatic tax rate updates

- Support for multi provincial rules

- CRA remittances

- T4 and ROE generation

- Reliability of year-end reporting

A payroll tool can be beautiful or feature packed, but if it cannot produce accurate, compliant pay runs, it does not belong in this list.

Time Tracking and Data Sync (20 🍁)

Payroll systems rely completely on the data that goes into them. This category evaluates how well each tool handles the inputs that determine payroll accuracy.

- Ability to import time sheets easily

- Integration with external scheduling or time tracking tools

- Correct handling of overtime, holidays, breaks, premiums

- Prevention of duplicate or mismatched entries

- Automatic syncs rather than manual spreadsheets

This category matters even more for shift based businesses where complex schedules are the norm.

Ease of Use (15 🍁)

Good payroll software should feel simple. We looked for:

- Clear workflows for recurring pay runs

- Straightforward setup

- Employee portals that are easy to understand

- Clean mobile and web experiences

Pricing & Scalability (15 🍁)

Small businesses need predictable costs. We evaluated:

- Transparent pricing

- Per employee costs suitable for teams under one hundred

- Whether add ons or hidden fees pushed the price out of reach

- How well the platform could scale as the business grows

Payroll should not become a financial burden as a team expands.

Support & Bilingual Availability (10 🍁)

Canadian businesses do not all operate in one language. We scored tools on:

- Quality and responsiveness of customer support

- Availability of trained Canadian payroll specialists

- Whether the interface and support were fully bilingual in English and French

This is especially important for businesses in bilingual regions like Quebec.

Integrations & Ecosystem (5 🍁)

Payroll rarely lives alone. We rewarded platforms that integrate well with:

- Accounting systems

- Scheduling and time tracking tools

- HR platforms

- APIs or automation features

Better integrations mean fewer errors and less manual work.

Baseline Requirements

Before any tool was considered for this list, it had to meet these minimum criteria:

- Cloud based SaaS

- CRA compliant

- Supported in Canada

- Suitable for SMBs with fewer than one hundred employees

If a platform missed any of these, it did not make the list.

This List Is Based on Research, Not Sponsorship

None of the companies featured here paid to be included. Our goal is simple, to give small businesses in Canada clear, unbiased information that helps them choose the right payroll solution. We combined public data and real world customer insights to bring you a list that reflects how these tools perform for Canadian SMBs right now.

Payroll rules change every year in Canada, so we also verified that each platform is keeping pace with current CRA requirements.

All contents of this article were last verified in January 2026.

Top Payroll Software for Small Business in Canada (2026)

The platforms below earned their place by delivering reliable CRA compliant payroll, solid support, and workflows that make sense for teams under one hundred employees. Whether you are paying a handful of hourly staff or managing a growing team across multiple provinces, these are the solutions that consistently rise to the top.

Here is the initial selection based on relevance, accuracy, popularity, Canadian market presence, and fit for SMBs.

- Wagepoint 🇨🇦

- QuickBooks Payroll (Canada)

- Payworks 🇨🇦

- Nethris 🇨🇦

- ADP Workforce Now Payroll

- Ceridian Dayforce PowerPay

- Employer D 🇨🇦

- Knit People 🇨🇦

- PaymentEvolution 🇨🇦

1. Wagepoint 🇨🇦

A Payroll Tool Designed for Small Teams that Want a Straightforward Pay Run

Wagepoint is a widely used payroll tool among Canadian small businesses. It focuses on core payroll tasks: running payroll accurately, keeping you compliant with the CRA, and making the whole process painless for teams without a dedicated payroll expert.

The platform is modern, easy to navigate, and designed for business owners who want payroll to “just work.” If your team is under one hundred employees and you value simplicity over bells and whistles, Wagepoint is a practical option contender.

Pros

- Very easy to use, even for first-time payroll admins

- CRA compliant with automated remittances

- Handles T4s, ROEs, and year-end reporting

- Clean employee self-service portal

- French-language resources and support available

- Integrates with payroll prep tools like Agendrix

Cons

- Limited flexibility for complex payroll scenarios

- Fewer advanced reporting or customization options

- Not ideal for businesses with highly variable or complex pay structures

Best for

Small Canadian businesses looking for a simple, reliable payroll solution that can be set up quickly and run with minimal effort.

Pricing

Solo $20/month + $4 per employee/contractor (one payroll/month) or Unlimited $40/month + $6 per employee/contractor (unlimited payrolls).

Score: 89 🍁

- Payroll Accuracy & CRA Compliance: 32/35

- Time Tracking & Data Sync: 17/20

- Ease of Use: 15/15

- Pricing & Scalability: 14/15

- Support & Bilingual Availability: 8/10

- Integrations & Ecosystem: 3/5

Where Wagepoint Stands Out

- One of the easiest payroll platforms to learn and use

- Strong automation for remittances and year-end forms

- Ideal for SMBs without in-house payroll expertise

- Works well when paired with a payroll preparation tool for accurate hours

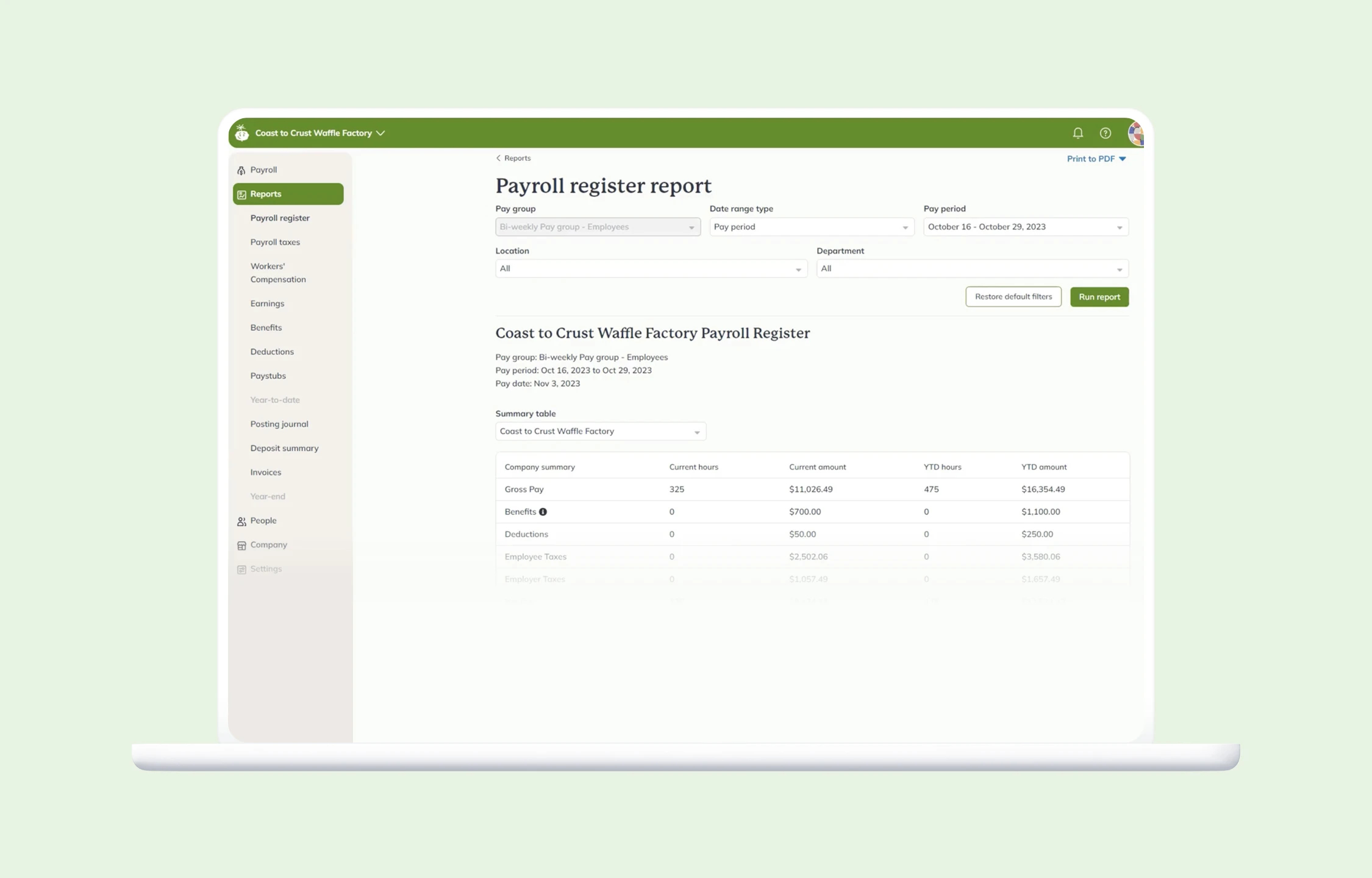

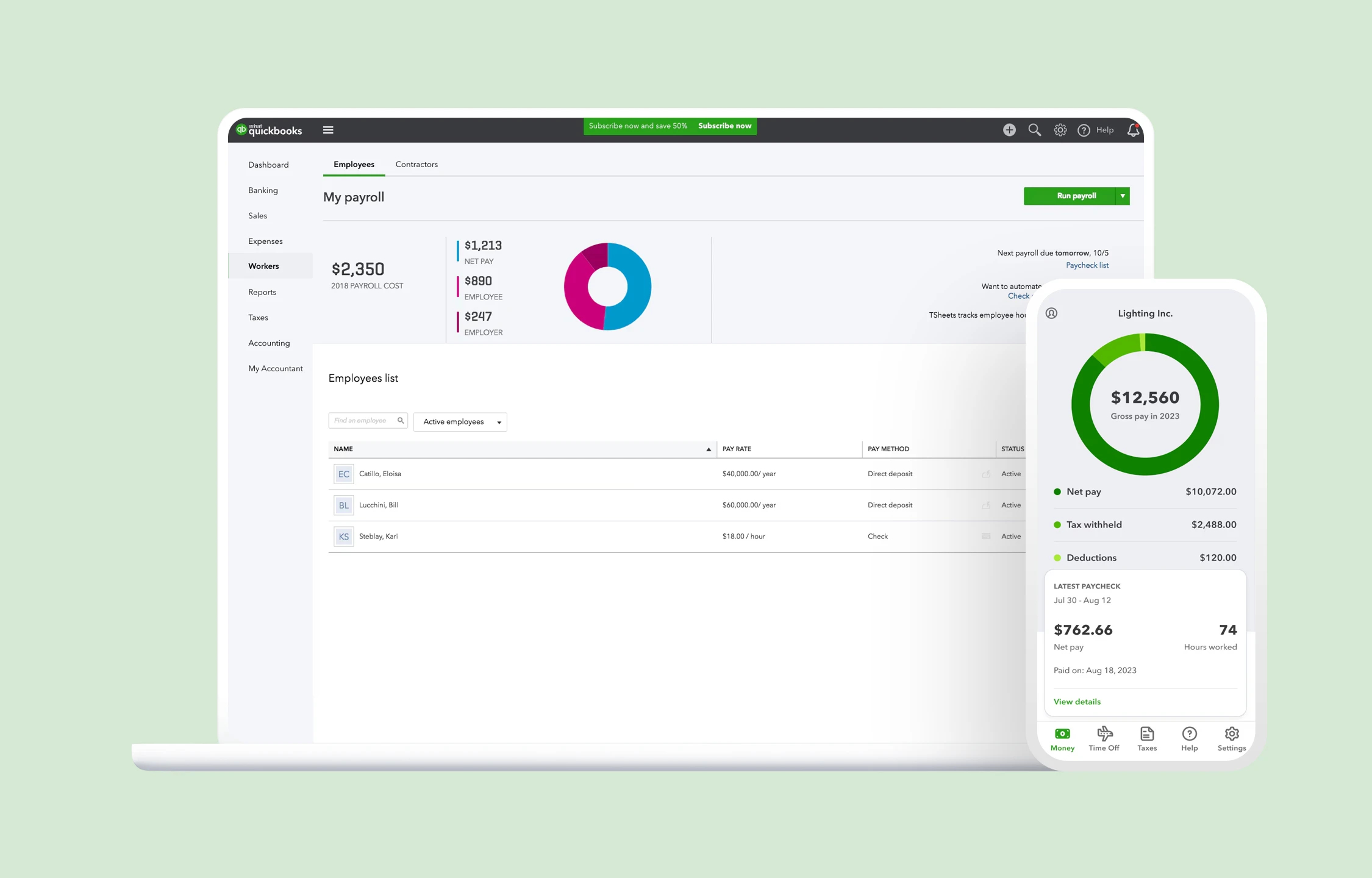

2. QuickBooks Payroll (Canada)

A Familiar, Accounting-First App that Pairs Payroll with QuickBooks Online

QuickBooks Payroll (Canada) is built for small teams that already use QuickBooks Online, or that want bookkeeping and payroll under one roof. It runs compliant Canadian payroll, creates T4s and RL-1s, supports ROE generation for upload to Service Canada, and offers included time tracking on higher plans.

Pros

- Offers three Canadian plans, with time tracking included on higher tiers

- T4s (and summaries) plus RL-1 slips/summary generation

- ROE support to create and download the official ROE file

- Standard 2-business-day lead time

- Bilingual help resources (EN/FR), Canada-specific support hub

- Large app ecosystem and native fit with QuickBooks accounting

- Integrates with payroll preparation tools like Agendrix

Cons

- RL-1 must be filed by the employer via Revenu Québec online services; amendments are limited in-product

- Advanced HR features are lighter than enterprise suites, some capabilities vary by plan

Best for

Canadian SMBs that want bookkeeping and payroll in one stack, or already use QuickBooks Online and need compliant payroll with built-in time tracking at higher tiers.

Pricing

Core, Premium, Elite plans available, visit Quickbooks Canadian payroll pricing page for current CAD rates.

Score: 87 🍁

- Payroll Accuracy & CRA Compliance: 32/35

- Time Tracking & Data Sync: 17/20

- Ease of Use: 13/15

- Pricing & Scalability: 13/15

- Support & Bilingual Availability: 8/10

- Integrations & Ecosystem: 4/5

Where QuickBooks Payroll Stands Out

A one-vendor workflow: accounting, payroll, and (on Premium/Elite) time tracking in a single stack. Plus ROE .BLK support and two-day direct deposit that meets most SMB needs.

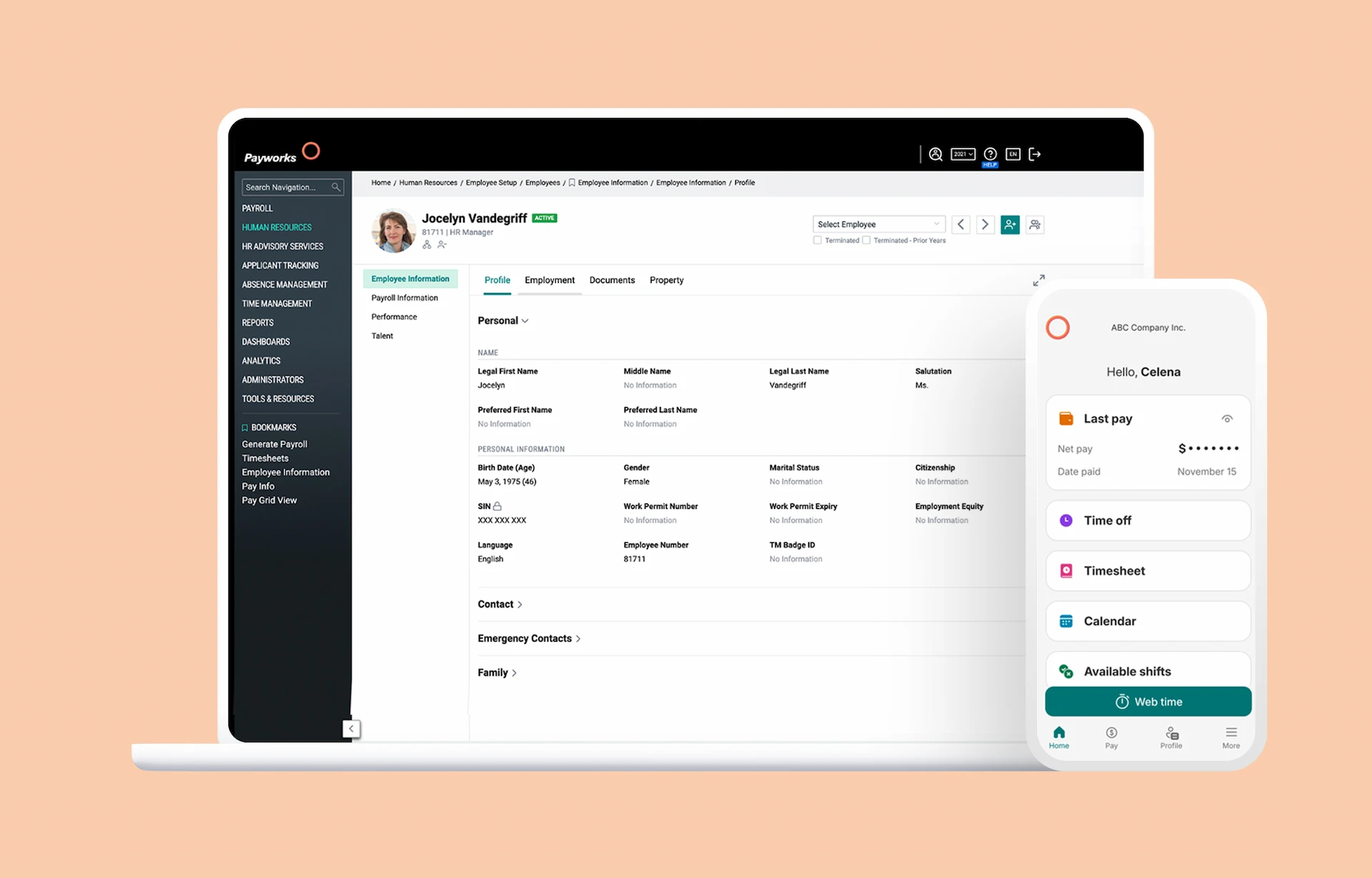

3. Payworks 🇨🇦

A Compliance-focused Payroll Provider with a Service-led Approach

Payworks is a long-standing Canadian payroll provider known for its reliability, strong compliance focus, and service-oriented approach. While it may not be the flashiest platform on the market, it consistently delivers accurate payroll, dependable support, and deep knowledge of Canadian and provincial regulations.

For small businesses that want payroll done right, every time, and prefer a proven partner over a trendy interface, Payworks is a common choice. It is particularly popular with organizations that value hands-on support and compliance-focused.

Pros

- Canadian-owned and operated

- Excellent CRA and provincial compliance

- Handles T4s, ROEs, remittances, and direct deposit

- Bilingual presence and Canada-based teams

- Accounting integrations: QuickBooks Online (native) and Xero connector options

- Integrates with payroll preparation tools like Agendrix

Cons

- User interface feels dated compared to newer SaaS platforms

- Setup can feel heavier than more lightweight payroll tools

- Pricing is quote-based and less transparent upfront

Best for

Canadian small businesses that prioritize compliance, accuracy, and support over modern UI or advanced customization.

Pricing

Quote-based; Payworks provides an instant quote tool to preview pricing. Pricing varies by company size and selected modules.

Score: 89 🍁

- Payroll Accuracy & CRA Compliance: 33/35

- Time Tracking & Data Sync: 17/20

- Ease of Use: 13/15

- Pricing & Scalability: 13/15

- Support & Bilingual Availability: 10/10

- Integrations & Ecosystem: 3/5

Where Payworks Stands Out

- One of the most trusted payroll providers in Canada

- Strong reputation for accuracy and compliance

- Excellent customer service with payroll experts

- Ideal for businesses that want peace of mind over fancy features

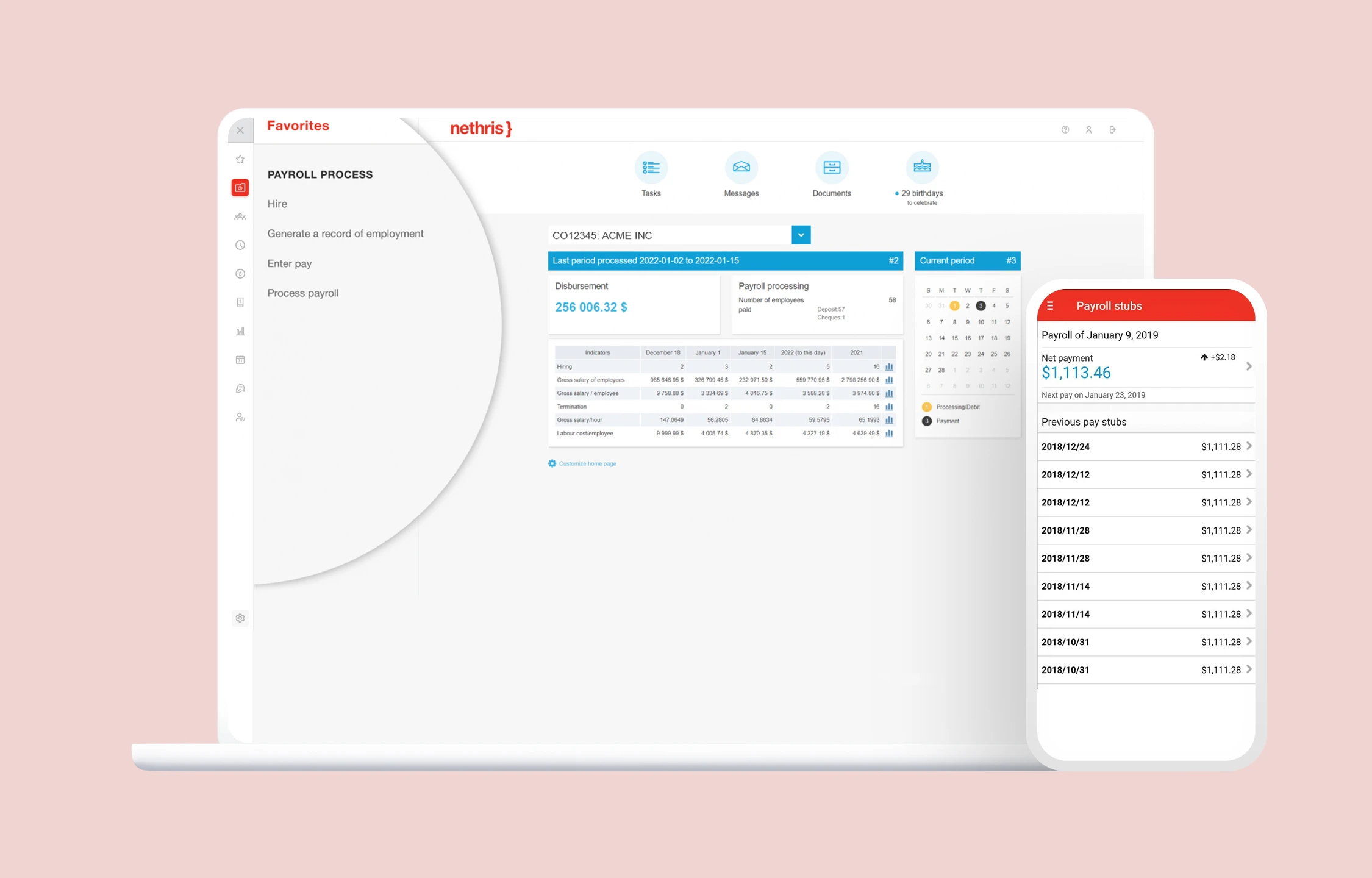

4. Nethris 🇨🇦

Payroll Software Built Around Canadian and Quebec Compliance Needs

Nethris delivers well-established and reliable payroll services available to Canadian SMBs. With nearly 50 years of experience and a fully bilingual platform, it handles everything from payroll calculations to year-end reporting with a level of accuracy many small businesses rely on.

The interface is straightforward, the support is genuinely helpful, and the platform is built squarely around Canadian regulations, which means fewer headaches and fewer surprises at tax time.

For businesses that want dependable payroll without unnecessary complexity, Nethris is often a strong fit.

Pros

- Fully compliant with Canadian and Quebec payroll rules

- Straightforward interface suited for small teams

- Handles T4s, ROEs, remittances, and direct deposits

- Bilingual platform and customer support

- Time management applies overtime/bonus rules and transmits approved hours to payroll

- Exports to accounting, including a QuickBooks Online transfer interface

- Employee self-service distributes T4 and RL-1 slips electronically

- Integrates smoothly with tools like Agendrix for payroll prep

Cons

- Not as modern or flashy as newer SaaS tools

- Pricing uses a simulator plus quote, still less transparent than SMB-first tools

Best for

Small Canadian businesses wanting dependable, bilingual payroll with strong compliance and minimal fuss.

Pricing

Simulator + quote-based. Nethris provides a pricing simulator and then finalizes cost by quote; price varies by modules and company size.

Score: 88 🍁

- Payroll Accuracy & CRA Compliance: 33/35

- Time Tracking & Data Sync: 17/20

- Ease of Use: 12/15

- Pricing & Scalability: 13/15

- Support & Bilingual Availability: 10/10

- Integrations & Ecosystem: 3/5

Where Nethris Stands Out

- One of the most trusted Canadian payroll providers

- Fully bilingual and tailored to both federal and provincial requirements

- Ideal balance between reliability and ease of use

- Strong reputation among accountants and payroll administrators

- Quebec-ready with electronic RL-1/T4 distribution, built-in time management, and direct accounting exports

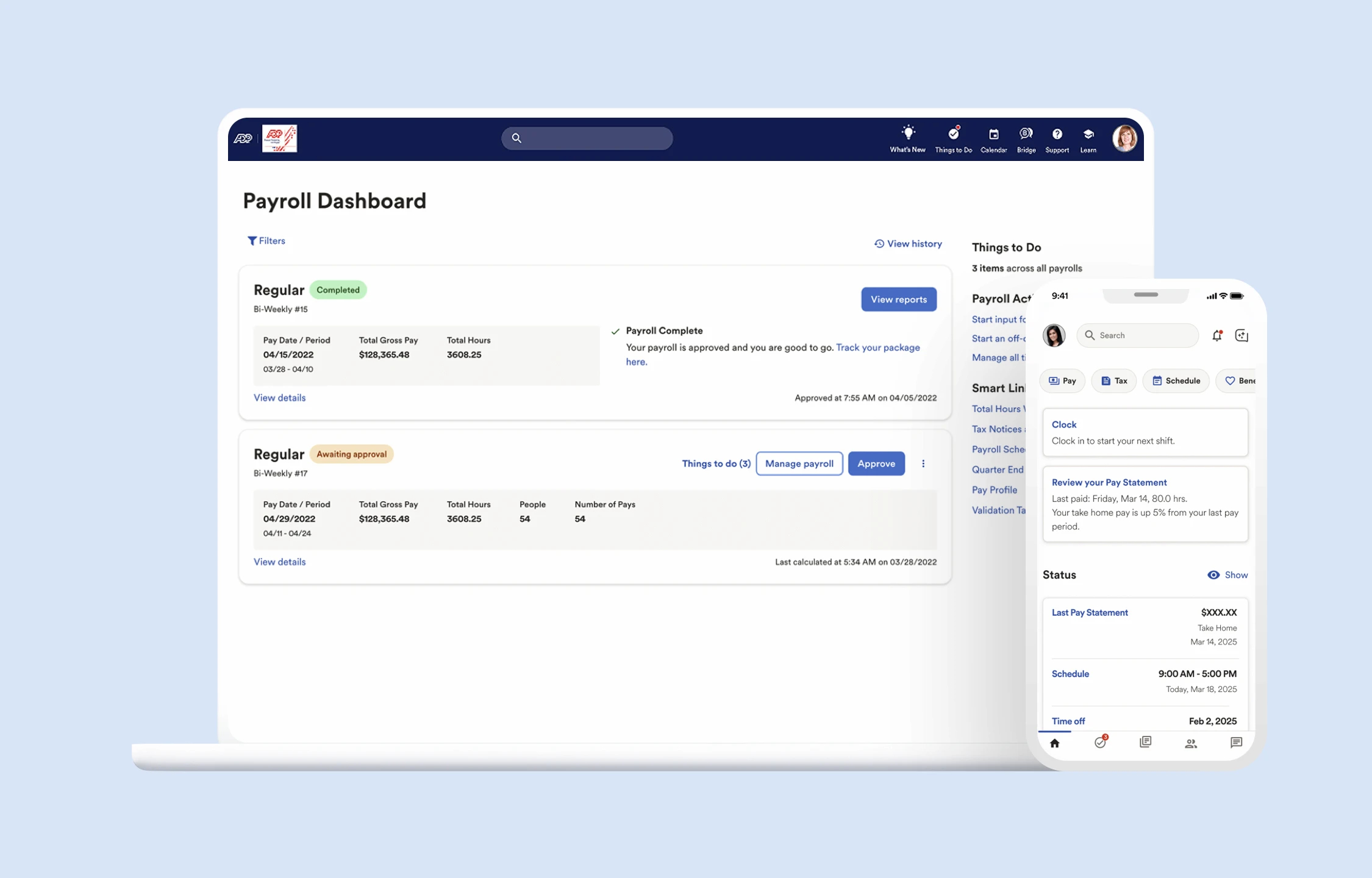

5. ADP Workforce Now Payroll

A Structured Payroll Platform for Businesses with More Complex Requirements

ADP Workforce Now is one of the most established payroll platforms in the world, and its Canadian payroll offering is both robust and deeply compliant. For small businesses that are growing quickly, operating across provinces, or dealing with more complex payroll scenarios, ADP provides a level of structure and reliability that many businesses choose it for.

That said, ADP is not the lightest solution on this list. It brings enterprise-grade power, which can feel heavy for very small teams, but for SMBs approaching or managing complexity, it can be a reasonable long-term option.

Pros

- Extremely reliable payroll processing with strong CRA compliance

- Handles multi-provincial payroll, complex deductions, and reporting

- Generates T4s, ROEs, and manages remittances accurately

- Scales well as businesses grow in size or complexity

- Bilingual (EN/FR) solution with Quebec-ready workflows

- Integrations and APIs via ADP’s ecosystem; accounting/connectors available

- ROE e-filing via ADP SmartCompliance (straight-through submission to Service Canada)

- Native time tracking, scheduling, absence to feed payroll

- Integrates with payroll preparation tools like Agendrix

Cons

- Interface can feel complex for small teams

- Setup and onboarding take more time than simpler payroll tools

- Pricing is quote-based and can be higher than SMB-first solutions

- French support quality may vary by plan or region

Best for

Canadian small businesses that are growing quickly, operating across provinces, or need a more advanced payroll system to support complex requirements.

Pricing

Quote-based: costs vary by size, modules, and complexity.

Score: 86 🍁

- Payroll Accuracy & CRA Compliance: 34/35

- Time Tracking & Data Sync: 17/20

- Ease of Use: 11/15

- Pricing & Scalability: 11/15

- Support & Bilingual Availability: 9/10

- Integrations & Ecosystem: 4/5

Where ADP Workforce Now Stands Out

- One of the most trusted payroll providers globally

- Bilingual delivery, ROE e-filing, and built-in time and attendance

- Excellent handling of complex and multi-provincial payroll

- Strong long-term scalability for growing businesses

- Works well when paired with a payroll preparation platform to simplify inputs

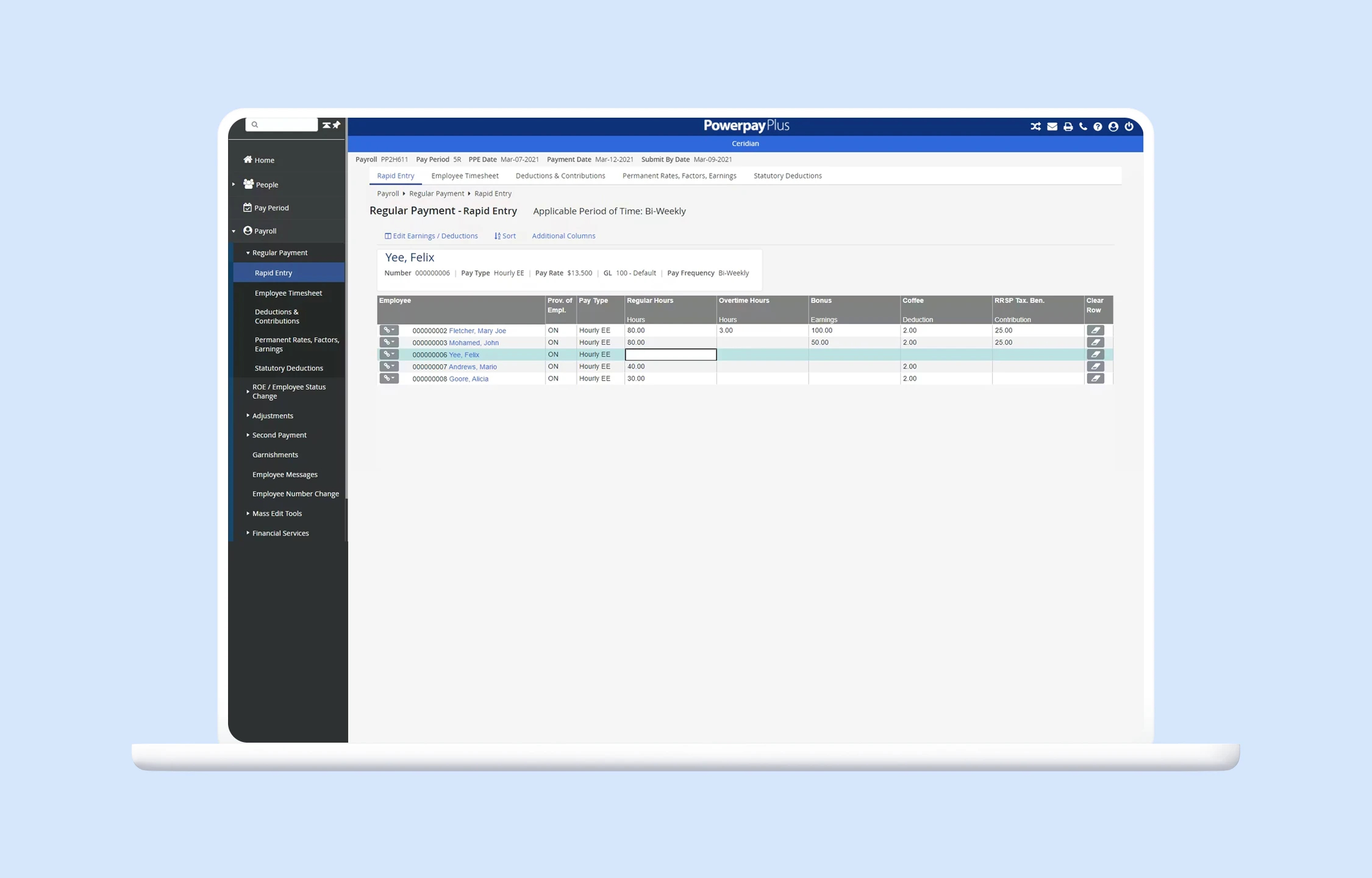

6. Ceridian Dayforce Powerpay

A Payroll Option Oriented Around Compliance and Consistent Processing

Ceridian Dayforce Powerpay is the small business payroll offering from Ceridian, a long-standing payroll and workforce management providers in Canada. Powerpay focuses squarely on payroll accuracy, compliance, and consistency, making it a strong option for small businesses that want confidence their payroll is handled by a provider with deep regulatory expertise.

While it does not offer the same lightweight experience as SMB-first tools like Wagepoint, Powerpay is often chosen when compliance, multi-provincial rules, and precision matter more than speed or aesthetics.

Pros

- Strong CRA and provincial compliance

- Accurate handling of payroll calculations, deductions, and remittances

- Dayforce Time & Attendance for Powerpay (DFTA) captures/approves hours and transmits to Powerpay

- Accounting Data Export posts journal entries to supported accounting packages

- Generates T4s, ROEs, and year-end reports reliably

- Backed by Dayforce/Ceridian’s long-standing Canadian payroll expertise

- Suitable for multi-provincial payroll scenarios

- Integrates with payroll preparation tools like Agendrix

Cons

- Interface feels more traditional than modern SMB payroll tools

- Setup can take longer than simpler platforms

- Limited flexibility outside core payroll workflows

- French-language resources are available, support experience can vary by plan and channel

Best for

Canadian small businesses that prioritize payroll accuracy and compliance, especially those operating across provinces or preparing for growth.

Pricing

Quote-based. Pricing depends on company size and payroll complexity.

Score: 83 🍁

- Payroll Accuracy & CRA Compliance: 34/35

- Time Tracking & Data Sync: 16/20

- Ease of Use: 11/15

- Pricing & Scalability: 11/15

- Support & Bilingual Availability: 8/10

- Integrations & Ecosystem: 3/5

Where Ceridian Dayforce Powerpay Stands Out

- Excellent compliance and regulatory accuracy

- Trusted payroll provider with decades of experience

- Strong fit for businesses with multi-provincial payroll needs

- Reliable option for SMBs that value precision over simplicity

- DFTA time tracking and an accounting data export reduce manual steps between scheduling, payroll, and books

7. Employer D 🇨🇦

A Quebec-oriented Payroll Platform Designed Around Provincial Requirements

Employer D is a Quebec-based payroll platform designed specifically around the realities of Canadian and Quebec payroll compliance. It’s commonly used in Quebec by businesses that want a straightforward, regulation-first payroll solution without unnecessary complexity.

The platform focuses on doing payroll right: accurate calculations, compliant remittances, and dependable year-end reporting. While its ecosystem and UI are more traditional than newer SaaS tools, Employer D is a common option for Quebec SMBs that value local expertise and bilingual support.

Pros

- Built specifically for Canadian and Quebec payroll rules

- Strong handling of QPP, EI, CNESST, and Revenu Québec requirements

- Built-in time management options available to capture/approve hours and feed payroll

- Generates T4s, RL-1s, ROEs, and remittances reliably

- Fully bilingual platform and customer support

- Mobile app for admins/employees (run confirmations, pay stubs, alerts)

- Integrates with payroll preparation tools like Agendrix

Cons

- Interface feels dated compared to newer payroll platforms

- Fewer integrations than national or enterprise payroll providers

- Less suited for businesses operating outside Quebec

Best for

Quebec-based small businesses looking for a locally focused, bilingual payroll solution with strong provincial compliance.

Pricing

Quote-based. Desjardins’ payroll cost estimator lets you preview fees by headcount and pay frequency.

Score: 82 🍁

- Payroll Accuracy & CRA Compliance: 32/35

- Time Tracking & Data Sync: 15/20

- Ease of Use: 11/15

- Pricing & Scalability: 12/15

- Support & Bilingual Availability: 10/10

- Integrations & Ecosystem: 2/5

Where Employer D Stands Out

- Excellent fit for Quebec payroll and provincial compliance

- Trusted by local accountants and payroll professionals

- Strong bilingual support and documentation

- Works well when paired with a payroll preparation platform to reduce errors

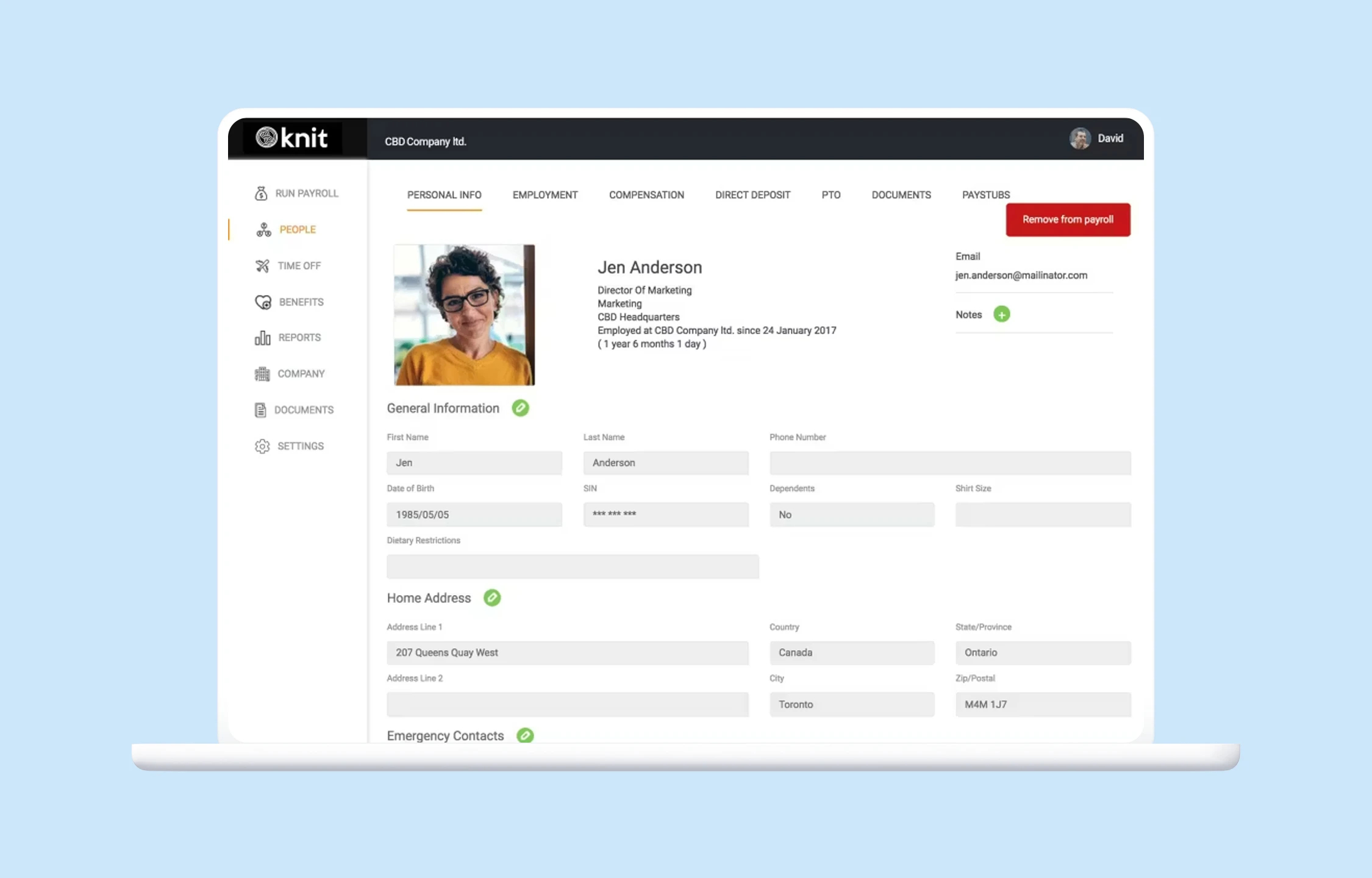

8. Knit People 🇨🇦

A Modern Payroll Platform for Teams that Want a Cleaner UI and Guided Workflows

Knit People is a newer Canadian payroll platform that some SMBs consider thanks to its modern interface, clear workflows, and focus on compliance without the headaches. It combines core payroll functions with features that make pay runs easy, predictable, and transparent. All while staying firmly rooted in Canadian payroll requirements.

If your small business wants a more contemporary payroll experience that still handles CRA compliance and year-end requirements capably, Knit People may be worth considering.

Pros

- Modern, intuitive interface that speeds adoption

- Strong compliance with Canadian federal and provincial payroll rules

- Direct deposit, automatic CRA remittances, T4 year-end, and ROE filing on your behalf

- Native time and attendance add-on that feeds payroll

- Built-in employee self-service features including access to paystubs, T4s and ROEs

- Accounting integrations: QuickBooks Online and Xero journal sync

- Quebec-aware help centre (Bill 96, RL-1 guidance), platform/help docs primarily in English

Cons

- Newer entrant, so fewer integrations than some legacy players

- Advanced customization and complex reporting could be deeper

- Support quality can vary depending on plan level

Best for

Canadian small businesses looking for a modern, easy to use payroll system that doesn’t compromise on compliance or essential features.

Pricing

Public pages list tiered pricing (Complete plan often cited as $50 base + $8/employee/month), confirm with sales for current CAD rates.

Score: 81 🍁

- Payroll Accuracy & CRA Compliance: 31/35

- Time Tracking & Data Sync: 15/20

- Ease of Use: 14/15

- Pricing & Scalability: 12/15

- Support & Bilingual Availability: 6/10

- Integrations & Ecosystem: 3/5

Where Knit People Stands Out

- A modern, employee-friendly experience that removes payroll complexity

- Modern, simple UI, platform/help centre primarily in English with Quebec-aware guidance

- Quick onboarding and easy ongoing payruns

- Great fit for businesses that don’t need enterprise complexity but want reliable payroll

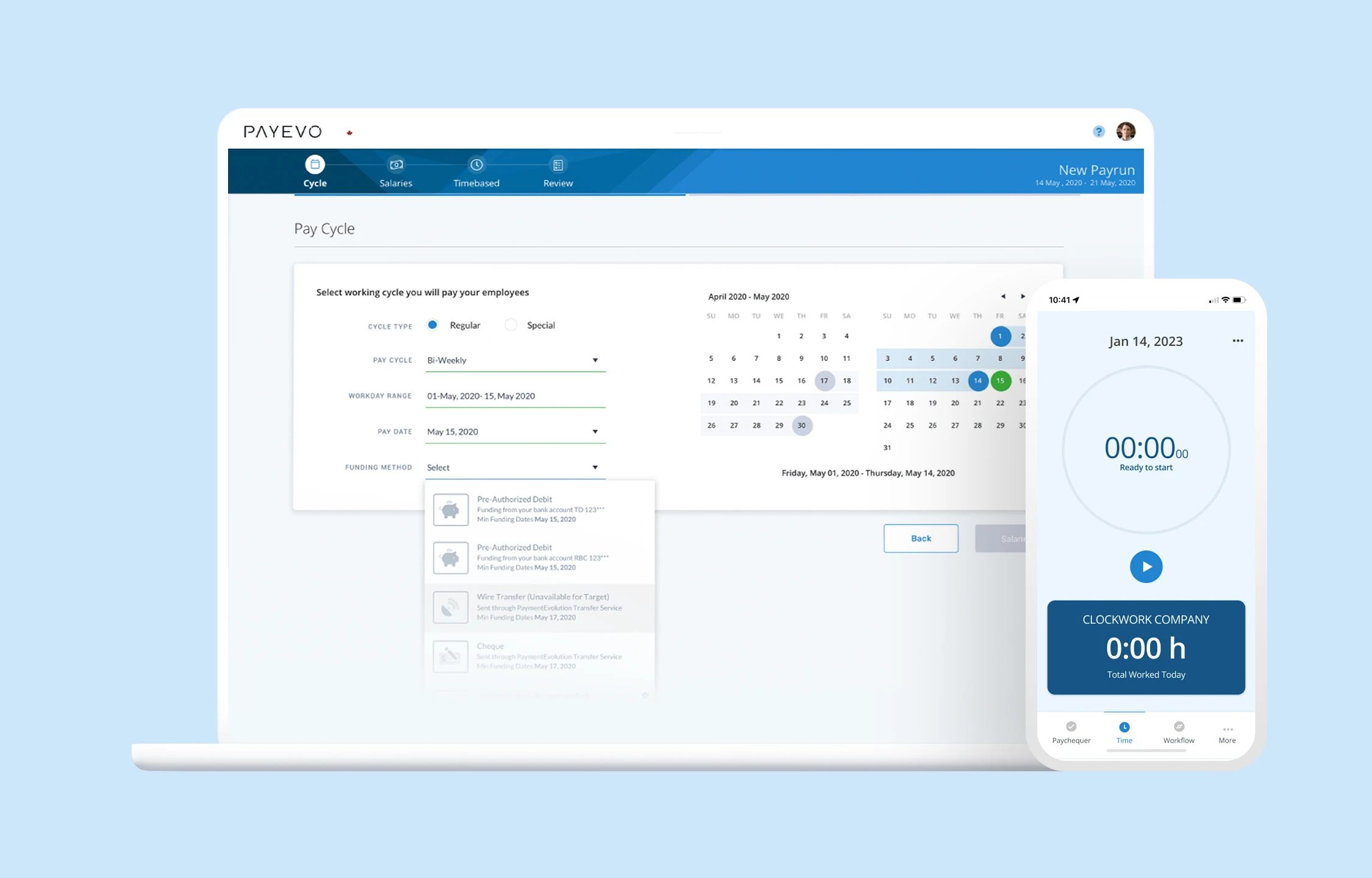

9. PaymentEvolution 🇨🇦

A Budget-Friendly, Per-Run Pricing Option with Solid Canadian Compliance

PaymentEvolution is popular with very small teams and cost-conscious SMBs thanks to per-employee, per-run pricing and no monthly base on its starter tier. It covers Canadian payroll essentials, offers direct deposit, and can pull approved hours from add-ons or external time apps. It also connects directly to QuickBooks Online for journal posting.

Pros

- Lowest-cost entry with direct deposit included

- Create T4/T4A and RL-1; ROE .BLK file for ROE Web upload

- TimeTracker add-on and integrations feed hours to payroll

- Post payroll journal entries to QuickBooks Online, listed on the Sage Canada Marketplace, additional add-ons available

- Bilingual resources available in the help centre

Cons

- Direct deposit timing is ~4 business days, slower than some competitors

- RL-1 amendments cannot be done through PaymentEvolution

- UI and ecosystem feel leaner than enterprise suites

Best for

Canadian micro-businesses and SMBs that want rock-bottom per-run pricing with compliant payroll and straightforward accounting/time connections.

Pricing

Growth: $0/month (≤3 employees) + $3.50/employee/run, Business Basic: $2.50/employee/run (min $25/month), Business Plus: $2.00/employee/run (min $75/month), remittances included, ePay setup fee applies.

Score: 80 🍁

- Payroll Accuracy & CRA Compliance: 30/35

- Time Tracking & Data Sync: 15/20

- Ease of Use: 12/15

- Pricing & Scalability: 12/15

- Support & Bilingual Availability: 8/10

- Integrations & Ecosystem: 3/5

Where PaymentEvolution Stands Out

- Lowest-cost entry for tiny teams

- Multiple accounting integrations

- TimeTracker add-on and imports from popular time apps feed approved hours

- Pragmatic pick when budget is the top constraint without sacrificing core compliance

Payroll Preparation Tools: The Apps That Make Payroll Accurate

Payroll software can only pay people correctly if the underlying data is correct. For businesses with hourly teams, that data comes from schedules, approved timesheets, overtime rules, breaks, holidays, and shift premiums. If those inputs are wrong or incomplete, payroll errors are almost guaranteed.

This is where payroll preparation tools come in. Instead of replacing payroll software, they sit upstream and make sure payroll runs on clean, validated data. By organizing hours, enforcing rules, and locking approvals before payday, payroll preparation platforms dramatically reduce errors, rework, and last-minute corrections.

For Canadian businesses with hourly or shift-based teams, payroll preparation is often the missing link between scheduling and accurate payroll.

Top Payroll Preparation Software in Canada

- Agendrix: Payroll preparation built specifically for Canadian hourly teams

- Connecteam: Time tracking and scheduling with approval workflows and payroll export support

Other Tools That Help Prepare Time Data

These tools can support payroll by capturing schedules or hours, but they are not designed as full payroll preparation platforms.

- 7shifts: Restaurant scheduling and time clocking with payroll data export and integrations

- Jibble, Hubstaff, Clockify: Time tracking and attendance tools that generate hours for payroll export

Scheduling-First Tools (Not Payroll Preparation)

These platforms focus primarily on scheduling. While they can export hours, they rely heavily on manual checks and are not built to enforce payroll rules.

- Humanity, When I Work: Scheduling-first tools with basic payroll exports

- Homebase: Scheduling and time tracking with export options, built-in payroll is generally U.S.-centric and limited for Canadian compliance

Most scheduling tools stop at “export hours.” Agendrix goes further by preparing payroll-ready data.

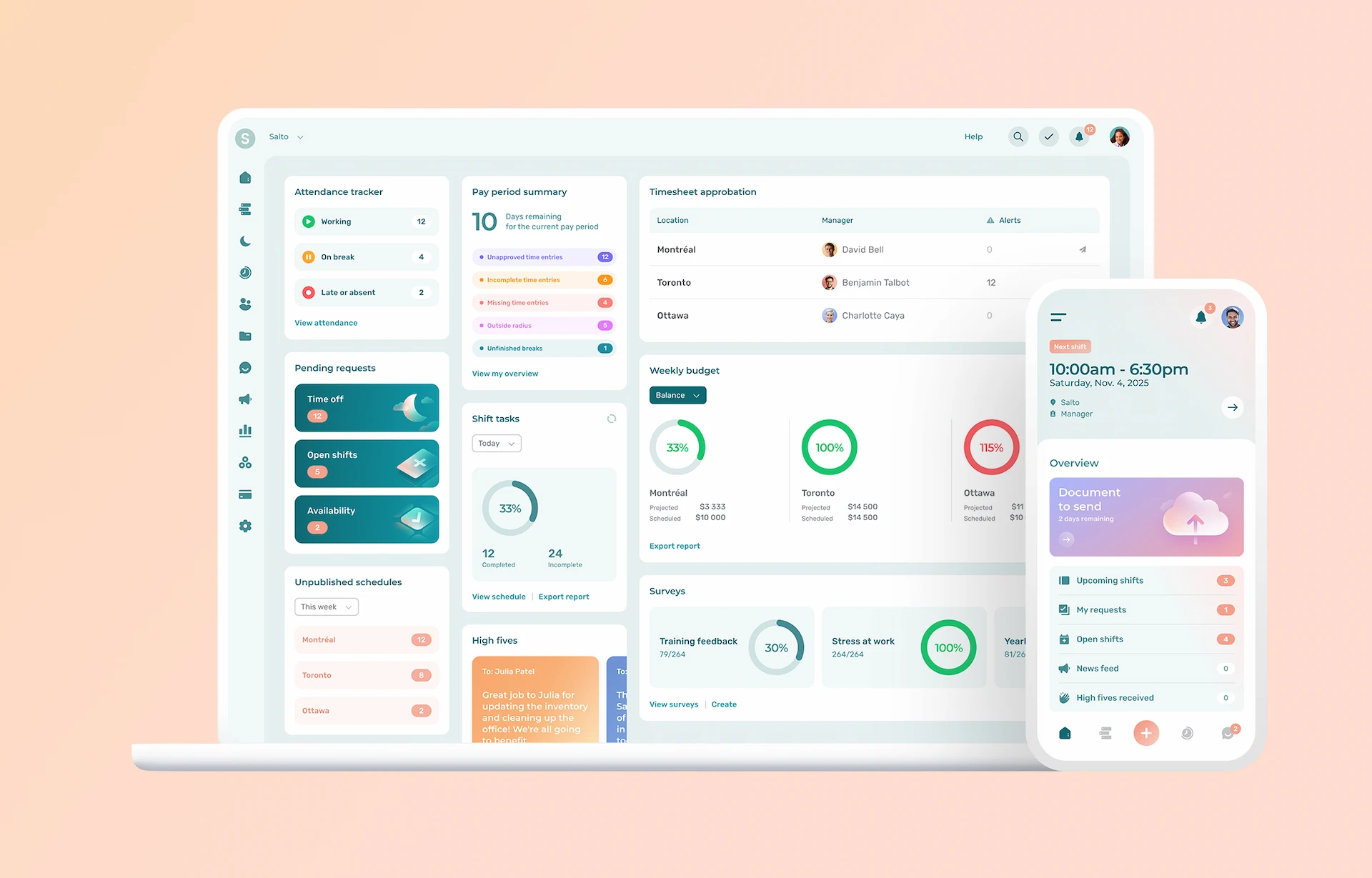

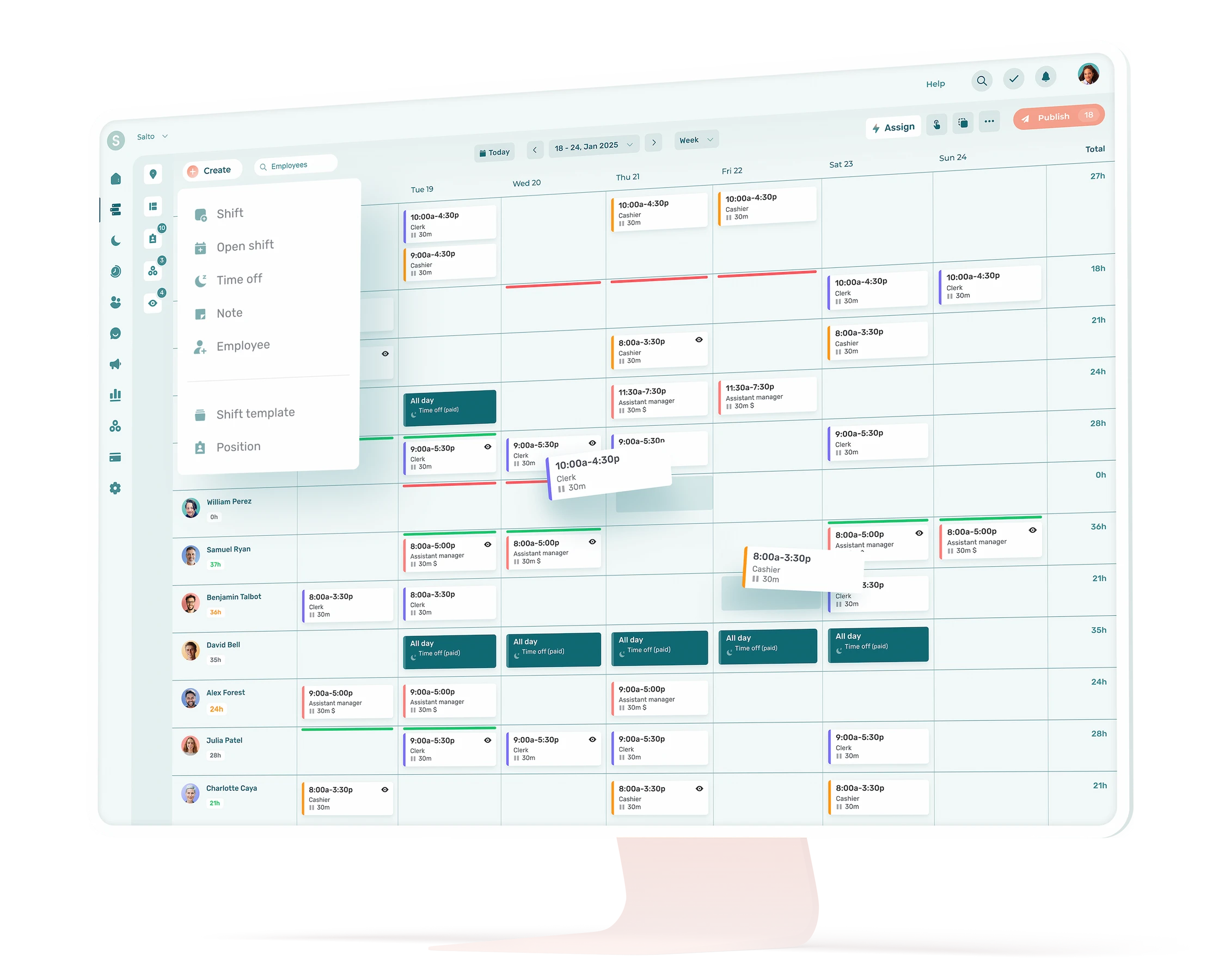

Agendrix

Payroll preparation built for Canadian hourly teams

Agendrix is not payroll software. It does not calculate taxes or issue paycheques. What it does is just as critical: it prepares accurate, approved, payroll-ready data before payroll even begins.

Built for businesses with hourly employees, Agendrix combines scheduling, time tracking, and rule enforcement into a single system that feeds clean data directly into payroll providers. This eliminates spreadsheets, reduces manual adjustments, and prevents many of the errors that typically show up on payday.

For teams running payroll through Nethris, ADP, Wagepoint, Employer D, and other Canadian providers, Agendrix acts as the control layer that keeps payroll accurate and predictable.

Why Agendrix stands out as a payroll preparation platform

- Full bilingual platform (EN/FR), built in Canada

- Built-in employee scheduling and time tracking, designed for hourly work

- Payroll controls for overtime rules, statutory holidays, PTO management, shift premiums, tip distribution, and breaks

- Approval workflows that lock hours before payroll runs

- Direct integrations with Employer D, Nethris, ADP, Wagepoint, and other Canadian payroll systems

- Canadian-focused logic, aligned with federal and provincial labour rules

Instead of fixing payroll after the fact, Agendrix helps teams get it right upstream.

How Other Scheduling Tools Compare

Tools like Humanity, When I Work, or Homebase can help create schedules and track hours, but they are not designed to prepare payroll data in a compliance-first way. They typically rely on manual exports, limited rule enforcement, and post-payroll corrections.

For very small teams or early-stage businesses, these tools can be a starting point. For growing Canadian SMBs that want fewer payroll errors and less admin time, a dedicated payroll preparation layer makes a noticeable difference.

How to Choose the Right Payroll Software for Your Small Business

The best payroll software isn’t the one with the longest feature list. It’s the one that fits how your business actually runs. For Canadian SMBs with fewer than one hundred employees, choosing payroll software comes down to a few practical questions.

1. Start with How Your Team Gets Paid

If your business runs on hourly or shift-based work, payroll accuracy depends on schedules, time tracking, and approvals. In that case, look for payroll software that works well with a payroll preparation platform, so hours are validated before payroll runs begin. Salaried teams may need less complexity, but still benefit from clean data and approvals.

2. Confirm Canadian and Provincial Compliance

Not all payroll software handles Canadian requirements equally. Make sure the platform supports CRA remittances, T4s, ROEs, and provincial rules. If you operate in Quebec, confirm support for RL-1s, CNESST, QPP, and Revenu Québec. Compliance should be built in, not bolted on.

3. Consider Ease of Use for Non-Experts

Most small businesses don’t have a dedicated payroll administrator. The right tool should make pay runs predictable and easy to repeat. Look for clear workflows, understandable employee portals, and support that can explain things in plain language.

4. Think About Integrations, Not Just Features

Payroll rarely lives alone. Consider how your payroll software connects with scheduling, time tracking, and accounting tools. Fewer manual exports and spreadsheets mean fewer errors. Strong integrations matter more than extra features you may never use.

5. Match Pricing to Your Current Size

Payroll pricing can add up quickly. For teams under one hundred employees, transparent pricing and predictable per-employee costs matter more than enterprise-grade flexibility. Make sure pricing scales reasonably as you grow, without forcing you into features you don’t need yet.

6. Don’t Underestimate Support and Language Needs

When payroll issues come up, fast and knowledgeable support matters. Canadian-based support and bilingual options (English and French) can make a real difference, especially for businesses operating in bilingual regions.

Payroll Works Best When the Data Is Accurate

In a modern Canadian payroll workflow, payroll preparation platforms like Agendrix handle schedules and hours, while payroll software manages calculations, taxes, and filings.

Payroll software handles the calculations, taxes, and filings. But accurate payroll starts well before payday. For Canadian small businesses with hourly teams, most payroll problems don’t come from the payroll system itself. They come from incomplete schedules, unapproved hours, missed overtime, and last-minute fixes.

The most reliable payroll workflows combine two things: a solid Canadian payroll provider and a payroll preparation platform that ensures the data going into payroll is clean, validated, and approved.

If payroll feels stressful, reactive, or error-prone, the fix often isn’t changing your payroll provider. It’s improving what happens before payroll starts.

👉 Start a free Agendrix trial and see how payroll preparation can simplify your entire pay process.

What is the difference between payroll software and payroll preparation?

Payroll software calculates employee pay, remits taxes, and generates required documents like T4s, RL-1s, and ROEs.

Payroll preparation software operates earlier in the process by organizing schedules, tracking hours worked, applying overtime and holiday rules, and approving time data before payroll runs begin.

Payroll preparation improves accuracy by ensuring payroll software receives clean, validated inputs.

What payroll software is best for small businesses in Canada?

The best payroll software for small businesses in Canada depends on team size, complexity, and provincial requirements. Common choices for SMBs under one hundred employees include Nethris, Wagepoint, Payworks, ADP Workforce Now, Ceridian Dayforce Powerpay, and Employer D.

These platforms support CRA compliance, year-end reporting, and Canadian payroll rules. Businesses with hourly teams see the best results when payroll software is paired with a payroll preparation platform.

Do I need both payroll prep and payroll software?

Most small businesses benefit from using both. Payroll software processes pay and tax filings, but it does not manage schedules or validate worked hours. Payroll preparation software ensures hours, overtime, premiums, and absences are accurate and approved before payroll begins. Using both together reduces payroll errors, rework, and last-minute corrections, especially for hourly or shift-based teams.

Which payroll tools support Quebec or bilingual teams?

Several payroll tools support bilingual teams and Quebec-specific payroll requirements. Nethris, Payworks, Ceridian Dayforce Powerpay, ADP Workforce Now, and Employer D offer French-language interfaces and support Quebec obligations such as RL-1s, QPP, CNESST, and Revenu Québec remittances.

Payroll preparation platforms like Agendrix also provide full bilingual support and integrate with Quebec payroll providers.

What does CRA compliance include?

CRA-compliant payroll includes accurate calculation of federal and provincial taxes, CPP or QPP contributions, EI deductions, employer remittances, and timely filings. It also includes issuing T4s, RL-1s where applicable, Records of Employment (ROEs), and maintaining compliant payroll records. Payroll systems must stay current with changing tax rates and labour regulations to remain compliant.