Flexible Benefits: Spend Less, Keep Employees Happy in Canadian Small Businesses

Key takeaways

- Flexible benefits help small businesses in Canada make every dollar count by meeting employees’ real needs, improving retention and reducing turnover costs.

- Turnover is expensive: up to $2,300 to replace a restaurant cook and $2,000–$10,000 for retail positions. Investing in flexibility pays off.

- Start small: offer 3 to 5 clear options and a $300–$500 budget per employee, then track usage and adjust as you go (see setup steps below).

- Affordable options include Health Spending Accounts (HSAs), wellness allowance, telemedicine services, local partnerships, or in-house programs, all easily managed in your HRIS software.

In a small business, every dollar matters. When it comes to employee benefits, offering the right ones is better than offering too many. Here’s how to move from a one-size-fits-all package to a flexible, personalized approach that profits both your employees and your bottom line.

Why Now?

Today’s economic climate presents plenty of challenges for small and medium-sized businesses in Canada. Managers are looking for smart, cost-effective ways to make the most of their resources without compromising the employee experience.

When budgets are tight and generous wage increases aren’t always possible, employee benefits become a strategic tool to attract, motivate, and retain talent, without necessarily increasing your payroll.

A Randstad Canada survey found that 60% of workers who feel their employer cares about their well-being plan to stay in their current job for at least the next two to three years.

The Real Cost of Replacing an Employee

Employee well-being can be hard to measure, but the cost of turnover isn’t.

- In a restaurant, replacing a cook (non management position) costs between $1,500 and $2,300, including recruitment, hiring, and training. That number can climb to nearly $6,000 when you factor in productivity losses. (Black Box Intelligence)

- In retail, replacing a sales associate costs between $2,000 and $10,000, roughly 30% to 50% of an entry level salary. (McKinsey, State of Fashion 2025)

Example: A restaurant with 20 employees

- A flexible benefits program costs $6,000 per year (20 employees × $300).

- Each avoided departure saves about $2,300, as shown above.

- Preventing just three departures per year saves $6,900, meaning the program pays for itself.

For small businesses in Canada, rethinking employee benefits isn’t just a nice to have; it’s a smart retention strategy. Choosing flexibility is a small change that can make a big difference for both your team and your bottom line.

What Are Flexible Benefits?

A flexible benefits program lets employees choose from a predefined menu of options funded by the employer. It allows each person to select what fits their real needs without increasing overall costs.

You keep control of the budget, while your employees gain autonomy.

Unlike traditional one-size-fits-all benefits, this approach gives every employee the freedom to pick what best suits their personal situation.

Common formats include:

- Cash allowance: a yearly amount employees can use toward the benefits they value most.

- Points-based system: the same idea, but employees spend points instead of dollars.

- Modular plan: predefined sets of benefits designed for different demographics, such as families or single employees.

- Enhanced core plan: a basic level of coverage with the option to purchase extra benefits by paying an additional premium.

- Health Spending Account (HSA): a dedicated fund employees can use for eligible health expenses according to their needs.

Tax Considerations to Keep in Mind

Some employee benefits are taxable in Canada, depending on how they are offered. Always verify the tax implications with the Canada Revenue Agency (CRA) or a qualified advisor before launching your program.

If your business operates in Quebec, confirm the rules with Revenu Québec as well, since provincial regulations may differ.

Clearly noting whether each benefit is taxable under CRA rules helps you avoid surprises and builds trust with your team.

Are Flexible Benefits Expensive for Small Businesses?

Not necessarily. It’s entirely possible to introduce flexible employee benefits on a limited budget. Here are a few affordable ideas:

- Allocate an annual amount per employee for wellness expenses

- Provide access to free or low cost tools and online training

- Negotiate group rates with local providers such as gyms or clinics

- Create a non monetary recognition system, such as symbolic rewards or thank you gestures

The goal isn’t to offer everything, but to offer meaningful choices that truly fit your team’s needs.

6 Steps to Introduce Flexible Benefits in a Small Business

Setting up flexible employee benefits might sound complicated, but with a bit of planning, it’s perfectly doable, even for a small team.

- Set your budget: Decide how much your business can allocate for employee benefits (for example, $300 to $500 per person or per role).

- Survey your employees to identify their needs: Use a short survey or one-on-one conversations to understand what your team values most.

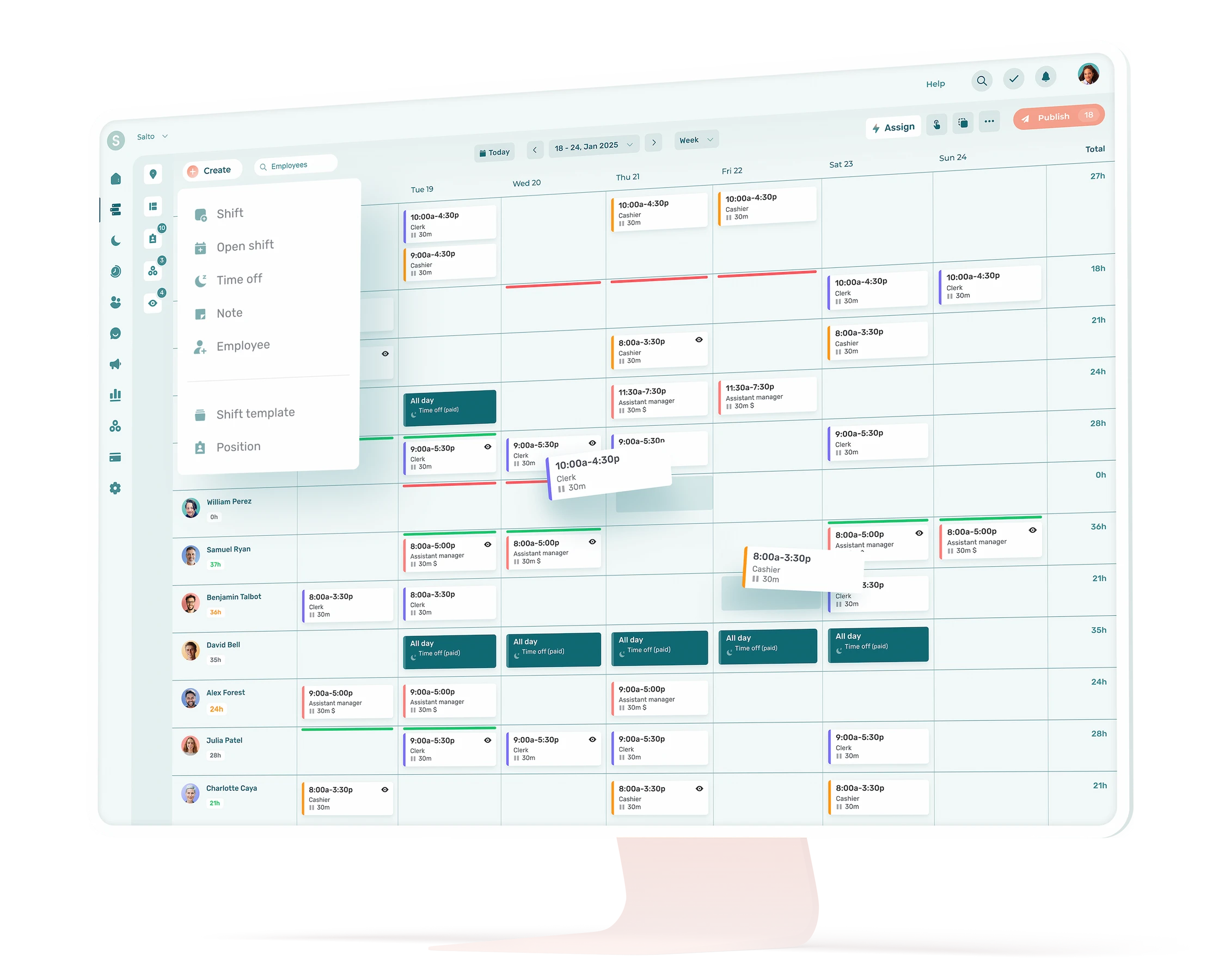

- Choose the right format: Decide whether you’ll use an allowance, a points system, an HSA, or another model. Determine how employees will share their choices and document everything through a simple form or an HR platform.

- Establish clear rules: Outline how each benefit can be used depending on the role to ensure fairness: set limits, eligibility, and proof requirements.

- Communicate the offer clearly: Make sure everyone understands the available options and has access to the documentation in your HR software.

- Adapt and evolve: Don’t hesitate to add or remove certain benefits based on employee feedback.

Start small with three to five simple options. A modest but well-structured program is far better than an overloaded and confusing one.

Examples of Flexible Benefits That Work Well

Health and Wellness

- Massage therapy, osteopathy, physiotherapy, chiropractic care, ergonomics, nutrition, psychology

- Wellness apps and platforms such as Calm, Headspace, or Peloton

- Health Spending Account (HSA)

- Memberships to gyms, ski resorts, climbing gyms, yoga studios, ball hockey leagues, or pools

Modular Insurance Options

Dental, vision, prescription drugs, disability, life, travel, or pet insurance

Mobility

Public transit passes, paid parking, public bike sharing (such as BIXI) or shared car rental (like Communauto) memberships, bike or carpooling allowances

Other Ideas

Internet or phone reimbursements, cultural memberships (museum, cinema), meal kits, RRSP or TFSA contributions, paid volunteer days, childcare or summer camp reimbursements

What Do Flexible Benefits Look Like?

Camila, 23, server and barista, part-time student

- Chooses a public transit pass and occasional access to psychological support during busy times like end of semesters.

Mark, 38, assistant manager with two young kids

- Wants to maximize dental and medical coverage for his family and appreciates partial reimbursements for childcare expenses.

Lucy, 52, cashier for 15 years

- Focuses on her well-being, choosing regular massage therapy sessions and travel insurance for her seasonal getaways.

Jonathan, 30, cook and outdoor enthusiast

- Uses his allowance for a climbing gym membership and occasionally for osteopathy sessions related to the physical nature of his work.

Advantages for Your Small Business

Offering flexible employee benefits isn’t just about keeping your team happy; it’s also a smart business decision.

It can help you:

Stand out from the competition

In today’s job market, large companies can often offer higher salaries. Small businesses, on the other hand, can stand out through agility and creativity. You don’t have to match corporate pay scales if your offer truly fits people’s real needs.

Attract a diverse range of employees

People’s needs vary, from young graduates and parents to those nearing retirement, newcomers to Canada, or students.

A flexible benefits program lets you appeal to all of them without managing multiple plans. One adaptable framework can cover a wide range of profiles.

Reduce employee turnover costs

Replacing an employee can cost thousands of dollars. By addressing your team’s real needs, you prevent unnecessary departures and boost satisfaction.

👉 Less turnover means lower costs for recruitment, training, and productivity loss.

Strengthen your company’s image

Even in a tough job market, employees are looking for more than basic working conditions. Given a similar salary, they will choose the company that values and understands them.

People stay where they feel appreciated. By adopting flexible benefits, you position your small business as a modern, human, and people-focused employer that both attracts and retains talent.

Advantages for Your Employees

Flexible employee benefits are not only practical for your team. They are also a powerful way to improve well-being and engagement.

Foster a genuine sense of appreciation

Instead of subscribing to a one-size-fits-all plan that may not suit them, employees become active participants in their own well-being. The effect is simple yet powerful. Feeling valued naturally increases engagement.

Offer more autonomy and boost motivation

Giving employees choices also means giving them decision-making power. It sends a clear message of trust and respect, helping strengthen the connection between management and staff and fueling long-term motivation.

Align your offer with each person’s reality

With flexible benefits, employees can build a package that fits their unique needs, priorities, and stage of life.

In the end, a flexible program is a retention tool that nurtures belonging and improves employees’ daily lives, which ultimately benefits your business too.

Tools to Manage Small Business Benefits Programs

Different tools can help you structure, manage, and communicate flexible employee benefits simply and effectively, even if you do not have a dedicated HR team.

All listed prices were accurate at the time of writing this article, in December 2025. For current pricing, visit each vendor’s website.

Flexible Benefits Platform: Tedy

A Canadian platform specializing in flexible benefits management. Employees can choose from a variety of options such as health, wellness, and transportation through a simple interface. Tedy uses a customizable annual allowance per employee and also provides support for small businesses.

Pricing: simple model with fixed fees, starting at $95 per month for teams of up to 20 employees.

👉 Ideal for small teams that want to offer flexibility without administrative complexity.

Telemedicine Platform: Dialogue

An online health platform offering services such as telemedicine, psychological support, and employee assistance programs. It provides flexible packages for small businesses, with unlimited or pay-per-use access for employees and their families.

Pricing: for small businesses with fewer than 100 employees, about $7.95 per employee per month.

👉 An excellent way to enhance your benefits program with affordable access to healthcare professionals.

Health Spending Accounts (HSA) through your insurer

Many Canadian insurers offer HSAs or personal spending accounts that employers can fund according to their budget. Employees can then use the funds to cover services not included in their standard plan, such as massage therapy, glasses, or gym memberships.

Pricing: depends on your existing group insurance plan.

👉 A simple and well-structured option ideal for small businesses already covered by a group plan.

In-house system using Excel and a form

For small teams or those with limited budgets, you can build an internal solution using a simple selection form and spreadsheet. Set a budget per employee, define eligible options, and track claims manually.

Pricing: free or almost free, apart from your time.

👉 A great starting point to test the concept before investing in a more automated solution.

For Small Budgets: Flexible Benefits Within Reach

Even with limited resources, it is possible to offer meaningful benefits. Here are a few simple ideas:

- Create a small annual allowance per employee, for example $150 to $300

- Offer a wellness or cultural gift card

- Negotiate group rates with a local partner such as a gym or massage therapist

- Provide occasional reimbursements upon receipt of an invoice

- Offer additional paid days off

Embrace Flexibility to Build Loyalty

For SMBs, offering flexible employee benefits is a winning strategy that meets your team’s real needs while making the most of your available resources, all without necessarily increasing your fixed costs.

By giving employees the freedom to choose the benefits that work best for them, you:

- Strengthen team loyalty and satisfaction

- Reduce turnover-related costs

- Position your business as a thoughtful, modern, and agile employer

Personalization is no longer a luxury. It is a practical way to build stable, engaged, and high-performing teams. Your people and your budget will thank you for it.

Are flexible benefits more expensive?

Not necessarily. Many small businesses start with a modest wellness allowance of $300 to $500 per employee and two or three local partnerships. The positive impact and real savings are often seen in improved retention and reduced absenteeism.

What is the difference between traditional and flexible benefits?

Traditional employee benefits are offered uniformly to all employees, with no room for personalization.

Flexible benefits, on the other hand, let employees choose the options that best meet their individual needs.

How do I know which benefits to offer?

Ask your team. A short survey is often enough to find out what matters most to them. Here is an example:

Which types of employee benefits would be most useful to you?

- Additional health insurance

- Access to a gym or wellness platform

- Paid time off

- Training or professional development budget

- Public transit pass or paid parking

- Other (please specify)

Is public transit considered a taxable benefit?

A reimbursed public transit pass is usually considered a taxable benefit in Canada, unless it meets specific conditions under Canada Revenue Agency (CRA) rules.

If your business operates in Quebec, check the requirements with Revenu Québec, as provincial rules may differ.

Keep detailed records of any reimbursements in your HRIS software to ensure compliance.

Which employee benefits do people value most?

- Group insurance plans, including health, dental, disability, and travel coverage

- Additional paid time off

- Wellness programs such as gym memberships, telemedicine, or psychological support

- Training or professional development budgets